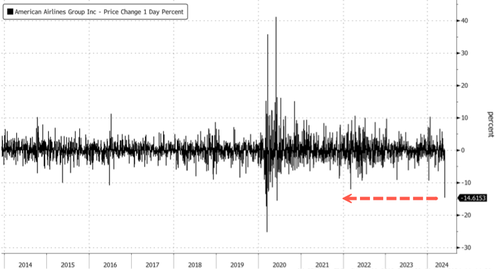

American Airlines Shares Plummet After Slashing Optimistic Guidance Issued Last Month

American Airlines shares hit turbulence Wednesday morning, tumbling the most since early Covid, after executives slashed the adjusted earnings per share outlook for the second quarter, just one month after issuing it. Additionally, Chief Commercial Officer Vasu Raja will step down in June. This news is particularly alarming for the carrier as it heads into the crucial summer travel season.

Last month, American executives projected that the second quarter of 2024 adjusted EPS would be between $1.15 and $1.45. However, the forecast has now been downshifted to between $1.00 and $1.15 for the quarter.

Here’s a snapshot of the second quarter forecast (courtesy of Bloomberg):

-

Sees adjusted EPS $1.00 to $1.15, saw $1.15 to $1.45, estimate $1.30 (Bloomberg Consensus)

-

Sees total revenue per available seat mile -5% to -6%, saw about -1% to -3%

-

Sees CASM ex-fuel 0% to +1%, saw about +1% to +3%

-

Sees adjusted operating margin about 8.5% to 10.5%, saw about 9.5% to 11.5%

On Wednesday, Chief Executive Officer Robert Isom acknowledged that American would revise its forecasting method after miscalculating US revenue trends.

„Our expectation for domestic performance has worsened materially since we provided guidance in April,” Isom said at an industry conference, adding, „This adjustment is largely due to a softer domestic environment than we were expecting and our performance within that environment.”

Here’s Wall Street’s response to the revision (courtesy of Bloomberg):

Seaport, Daniel McKenzie (cuts to neutral from buy)

Revenue challenges likely to continue for American beyond the summer due to escalating ultra-low cost carrier growth taking place at the airline’s top hubs, McKenzie says

Notes Spirit and Frontier are shifting growth to Dallas Fort Worth International and Charlotte Douglas International, which are the top two hubs for American

„We’re also seeing 3Q24 pricing that is beginning to soften at the industry level, hence our view that the pricing weakness to Europe and the Caribbean likely does not reverse in 3Q”

Jefferies, Sheila Kahyaoglu (cuts to hold from buy)

The thesis Kahyaoglu had used to upgrade American to buy started to „drift” following a disappointing earnings day, she says, adding it’s now clear the strategy has not gone as planned

„Cost management is a strong suit but the topline lags peers through ’24, given tougher-than-expected industry capacity in the 75% short-haul network, and lack of strategy traction”

PT cut to $12 from $17

JPMorgan, Jamie Baker (overweight)

Softer revenue was the „culprit” for the guide-down, Baker writes, noting it „handily overwhelmed slightly better cost performance”

While disappointing, Baker is not hugely surprised, noting that the initial 2Q revenue guidance was „met with widespread buyside and sellside skepticism, including our own, given it implied a level of sequential strengthening meaningfully ahead of historic norms”

Baker has no specific insight on the departure of Raja, but is increasingly interested as to whether any strategic pivots may be on the horizon

TD Cowen, Helane Becker (buy)

The guidance cut is „likely no surprise to investors, given prior commentary by ULCCs noting soft domestic revenue trends,” Becker writes in note

Notes departure of Raja; flags that the strategy presented by American earlier this year was „poorly received,” particularly the network plan

PT cut to $16 from $18

Evercore ISI, Duane Pfennigwerth (inline)

Raja’s departure follows weeks of speculation about a potential sabbatical and upgraded responsibilities of some revenue management, Pfennigwerth notes

„Given the change in commercial leadership, we suspect the focus on lower cost distribution (de-emphasizing corporate sales channels), including restructuring/ layoffs of American’s corporate sales organization may be continuing to play a role in softer relative trend”

Notes 2Q revenue guidance likely had more ambitious underlying assumptions compared to peers when it was first given; adds that tighter capacity planning would be a „step in the right direction”

Vital Knowledge

„The driver of the miss is pricing, with RASM estimated to come in down 5-6% Y/Y, a sharp cut from the prior down 1-3% forecast (this is the latest example of how disinflationary/deflationary forces may be macro positives but are starting to become micro negatives),” according to the firm

Says the improved CASM [cost per available seat mile] and fuel forecasts aren’t enough to compensate for the RASM headwind.

In markets, shares of American tumbled 14% in New York, the most significant intraday decline since June 2020.

Industry peers, including United Airlines and Delta Air Lines, sank more than 2%. Southwest Airlines plunged 5%.

As American goes… So does the industry.

Still, there are questions about whether air travel demand is beginning to stall in US markets. Perhaps not yet, after Transportation Security Administration data showed that last Friday, a record number of passengers were screened at checkpoints.

Tyler Durden

Wed, 05/29/2024 – 11:25