Bank of Canada Cuts Rates By 25bps As Expected, First G7 Central Bank To Launch Easing Cycle

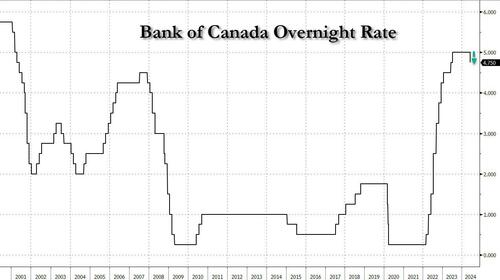

As widely expected after significant dovish commentary in recent months, moments ago the Bank of Canada cut rates by 25bps from 5.00% to 4.75% as a majority of economists expected, and signaled that it is „reasonable to expect further cuts” if inflation eases.

The 25bps cut, which comes just under a year since its last 25bps rate hike in July 2023, means that Canada is the first G7-member central bank to launch an easing cycle.

In the drafted opening remarks of Governor Tiff Macklem wrote that: „If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time.”

Here is the balance of his commentary:

- „Further progress in bringing down inflation is likely to be uneven and risks remain.”

- „If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate.”

- „But total consumer price index (CPI) inflation has declined consistently over the course of this year, and indicators of underlying inflation increasingly point to a sustained easing” „Inflation could be higher if global tensions escalate, if house prices in Canada rise faster than expected, or if wage growth remains high relative to productivity.”

- „With the economy in excess supply, there is room for growth even as inflation continues to recede.”

- „Although Q1 growth was weaken than bank forecast, consumption growth was solid while business investment and housing activity also increased.”

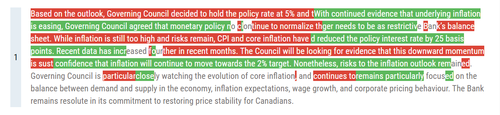

Taking a closer look at the BOC statement we find the following highlights:

- With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points.

- Recent data has increased our confidence that inflation will continue to move towards the 2% target. Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

- The Bank remains resolute in its commitment to restoring price stability for Canadians.

- Three month measures of core inflation suggest continued downward momentum in CPI

While the decision was largely expected, Canadian stocks are enjoying a broad-based rally on the central bank’s interest rate cut and dovish tone. All 11 S&P/TSX Composite Sectors are green at 9:52 a.m. in Toronto, led by interest-rate sensitive utilities. At the moment, 168 index members rising, 47 falling and 7 unchanged. In FX, the USDCAD rose 0.2% after the decision while Canada 2y yield dips 4bp.

Tyler Durden

Wed, 06/05/2024 – 09:58