Bullion & Big-Tech Soar, Treasury Yields Tumble Amid US Macro-Meltdown

A wild (holiday-shortened and illiquid) week of dismal macro data and dramatic market divergences.

It was 100% – a bad news week…’hard landing’ much?

Source: Bloomberg

…with 'hard’ data hammered and 'soft’ data’s rebound ended…

Source: Bloomberg

…which means 'good news’ for rate-cut expectations (which dovishly soared)…

Source: Bloomberg

…and that sent stocks (some of them), bonds (all of them) and commodities (most of them) soaring while 'currencies’ tumbled.

Nasdaq ripped to its best week since late April and second best week since the first week of November. Small Caps ended the week red as short-squeeze ammo ran dry…

Mag7 stocks drove the Nasdaq (and S&P) outperformance, ripping over 6% from Monday’s opening lows…

Source: Bloomberg

Which led Consumer Discretionary and Tech higher while Energy stocks were sold…

Source: Bloomberg

And its very concentrated still with the equal weight S&P going nowhere at all…

Source: Bloomberg

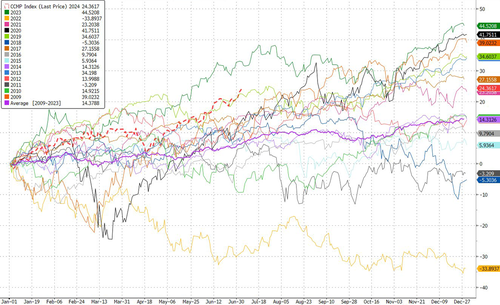

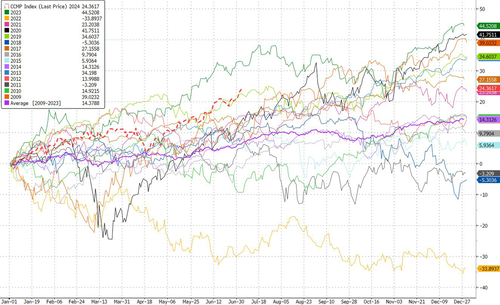

As a reminder, the first 10 days of July are historically the strongest period of the year for stocks…

It’s all Mag7, all the time…

Source: Bloomberg

This is Nasdaq’s best start to a year since the GFC…

Source: Bloomberg

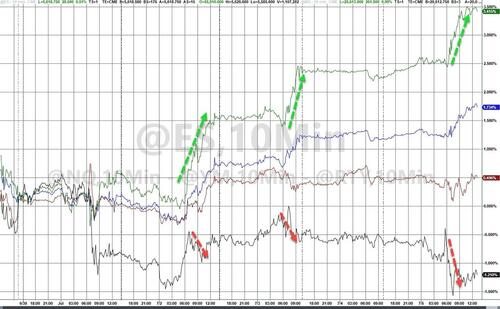

Treasury yields tumbled this week, led by the short-end of the curve…

Source: Bloomberg

The dollar was dumped this week…

Source: Bloomberg

Cryptos were clubbed like a baby seal this week with Ethereum underperforming Bitcoin (despite all the Mt.Gox FUD over BTC and BCH)…

Source: Bloomberg

Bitcoin broke below its 200DMA overnight and then spent the rest of the day session in the US trying to get back to it….

Source: Bloomberg

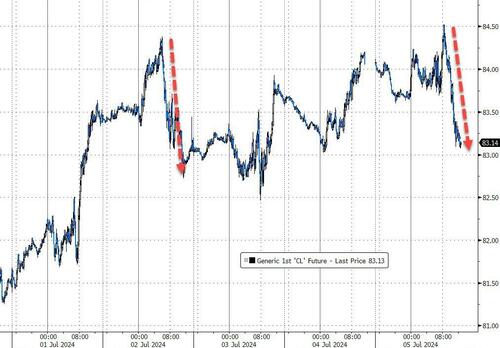

Oil ended the week higher, despite two good smackdowns around $84 (WTI) during the week…

Source: Bloomberg

Spot Gold prices soared on the week, back above the 50DMA and near record highs once again…

Source: Bloomberg

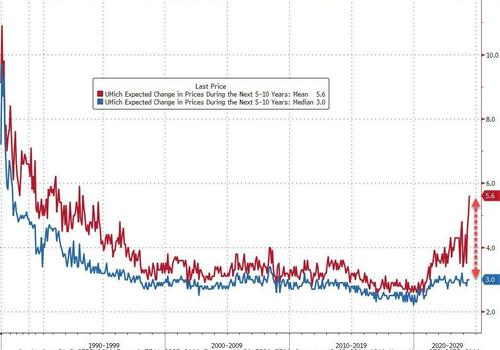

Finally, this is an odd chart for you to keep an eye on. While the much-watched UMich inflation expectations index (median) has been stabilizing over the past year or so (fitting the narrative of disinflation and Fed victory); the mean longer-term inflation expectation has blown back out in recent months to its highest since February 1993…

Source: Bloomberg

The huge spread between mean and median implies that the distribution of inflation expectations has a very, very high right-tail (i.e. a relatively large number of respondents are expecting significantly higher inflation over the next 5-10 years). That is definitely not a narrative-confirming chart.

Tyler Durden

Fri, 07/05/2024 – 16:00