Burger King Owner’s Earnings Fall Short Of Estimates On „Consumer Pressures”

Restaurant Brands International, the owner of Burger King, Tim Hortons, Popeyes, and Firehouse Subs, posted second-quarter earnings that were weaker than expected by the average Wall Street analyst. This is more evidence that the consumer downturn theme is gaining momentum as low/mid-tier consumers pull back on spending amid elevated inflation and high interest rates.

„Our priorities and balance of thoughtful investments with cost discipline allow us to navigate short-term consumer pressures and drive sustainable results for our business and our franchisees,” CEO Josh Kobza stated in the second quarter earnings result press release.

Here’s a snapshot of what RBI reported compared with what the average Wall Street analyst tracked by Bloomberg was expecting:

- Comparable sales +1.9% vs. +9.6% y/y, estimate +2.88% (Bloomberg Consensus)

RBI’s earnings per share, excluding certain items, and revenues were roughly in line for the quarter.

-

Adjusted EPS 86c vs. 85c y/y, estimate 87c

-

Revenue $2.08 billion, +17% y/y, estimate $2.03 billion

Comparable sales beat at Tim Hortons but missed at Burger King, Popeye’s, and Firehouse Subs.

-

Tim Horton’s comparable sales +4.6%, estimate +3.77%

-

Burger King comparable sales -0.1%, estimate +3.42%

-

Popeye’s comparable sales +0.5%, estimate +3.3%

-

Firehouse Subs comparable sales -0.1%, estimate +2.46%

Bloomberg pointed out:

The company missed estimates for sales growth at restaurants open more than 13 months, as a stronger-than-foreseen showing for Tim Hortons’ Canada business couldn’t offset unexpected weakness in the rest of the operation. System-wide sales, which also include newer restaurants, was also just short of expectations.

Consumers around the world are pulling back from dining out as they cope with elevated prices and less spending money. Chains have responded with a series of deals, including Burger King’s $5 meal in the US, which it launched ahead of rival McDonald’s Corp. in a fight for market share.

RBI reaffirmed its long-term guidance from a February investor event, forecasting an average growth of 3% in comparable sales and 5% in net restaurant growth through 2028.

RBI joins the growing list of companies exposed to low/mid-tier consumers who have warned about a pullback in customer spending. These companies have either been cutting prices or offering 'deals.’

Recall our note from July 9 titled „Restaurant Stocks Slide As Wall Street Sours On Consumer.”

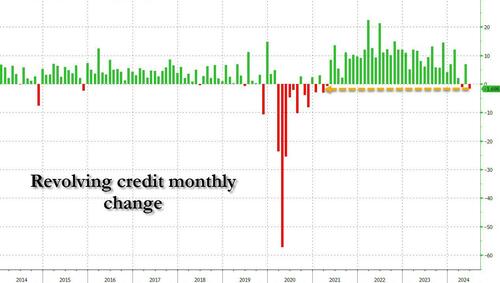

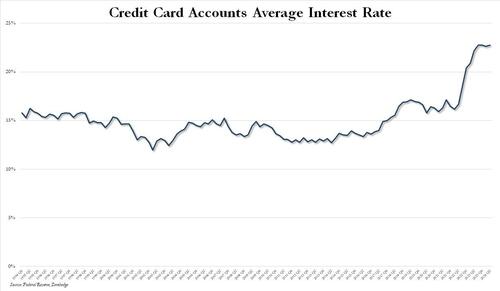

On Wednesday, new revolving credit data from June unexpectedly tumbled as consumers near a breaking point.

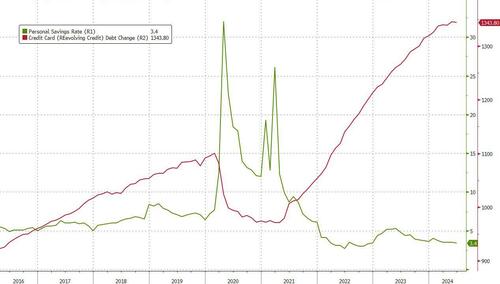

Maxed out credit cards and record low savings, no wonder consumers are pulling back on restaurant spending.

Let’s not forget this.

Even Disney warned this week that sliding theme park demand and „moderating consumer demand” should weigh on experiences in the coming quarters.

Consumers are under severe stress. And you bet these folks will vote with their empty wallets come November.

Tyler Durden

Thu, 08/08/2024 – 13:20