Dollar General Shares Crash After Earnings Miss & Outlook Slashed On „Financially Constrained Core Consumer”

Shares of Dollar General Corp. crashed 23.5% to hit levels not seen since 2018 in premarket trading in New York following a disappointing second-quarter earnings report. The nation’s largest discount retailer missed Wall Street’s profit and sales expectations and slashed its full-year forecast. The retailer warned that its core customers „feel financially constrained.”

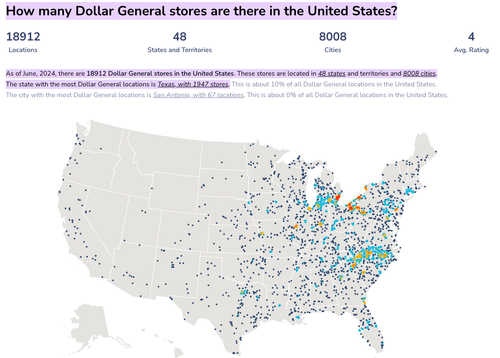

The discount retailer, which has nearly 19,000 locations in 48 states and 8,000 cities, reported adjusted earnings per share of $1.70 for the second quarter, missing the average estimate of analysts tracked by Bloomberg of $1.79. Revenue came in at $10.21 billion, below estimates of $10.37 billion, but still up 4.2% year-over-year. Same-store sales rose .5%, missing the 2.07% estimate.

Here’s a snapshot of second-quarter earnings (courtesy of Bloomberg):

-

EPS $1.70 vs. $2.13 y/y, estimate $1.79

-

Net sales $10.21 billion, +4.2% y/y, estimate $10.37 billion

-

Comparable sales +0.5% vs. -0.1% y/y, estimate +2.07%

-

Gross margin 30% vs. 31.1% y/y, estimate 30.3%

-

SG&A as percentage of revenue 24.6% vs. 24% y/y, estimate 24.4%

-

Operating profit $550.0 million, -21% y/y, estimate $587.5 million

DG lowered its full-year outlook for sales and profit. The company slashed its guidance ranges for EPS to $5.50 to $6.20 from $6.80 to $7.55 and for same-store sales growth to 1% to 1.6% from 2% to 2.7%. Bloomberg consensus was around 2.47%.

More color on the full-year outlook (courtesy of Bloomberg):

-

Sees comparable sales +1% to +1.6%, saw +2% to +2.7%, estimate +2.47% (Bloomberg Consensus)

-

Sees EPS $5.50 to $6.20, saw about $6.80 to $7.55, estimate $7.11

-

Sees net sales +4.7% to +5.3%, saw +6% to +6.7%

-

Sees effective tax rate 23%, saw 22.5% to 23.5%

-

Still sees capital expenditure $1.3 billion to $1.4 billion, estimate $1.39 billion

CEO Todd Vasos acknowledged consumers are being pressured in today’s environment of elevated inflation and high interest rates:

„While we believe the softer sales trends are partially attributable to a core customer who feels financially constrained, we know the importance of controlling what we can control. With the evolving retail and consumer landscape in mind, we are taking decisive action to further enhance our value and convenience offering, as well as the in-store experience for our associates and customers.”

Shares crashed 23.5% in premarket trading to the midpoint of the $94 handle, the lowest level since early 2018.

For analysts at consumer desks, DG’s nearly 19,000 stores across the US offer valuable insight into the financial health of low- to mid-tier consumers.

DG’s dismal report reminds us that the consumer downturn theme is still in play and should worsen in the months ahead. Hence, the Fed’s interest rate-cutting cycle may begin as early as Sept. 18. The Fed rarely cuts into good times. The Biden-Harris team’s disastrous Bidenomics policies have financially crushed an entire generation of consumers.

Tyler Durden

Thu, 08/29/2024 – 08:20