„Getting Fully Valued”: Nvidia Receives Rare Downgrade

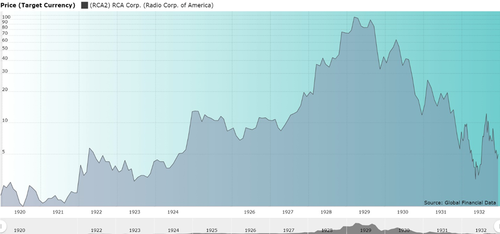

Nvidia’s price surge over the past 18 months mirrors the exuberance of the 'Roaring Twenties,’ particularly the bull market of the late 1920s, and is reminiscent of Radio Corporation of America’s meteoric rise following the emergence of the radio industry.

According to a recent note from Bryan Taylor, the chief economist at Global Financial Data, RCA shares soared 200-fold in the 1920s. By the late 1929s, RCA shares peaked then crashed 98% through early 1932.

These days, the resilient economy (however, the labor market is slowing) and the AI-fueled bubble (it only took 23 days for Nvidia to add a trillion dollars in market cap) have Goldman’s chief equity strategist David Kostin telling clients that quarter two earnings season will be a massively high bar to beat—and this could be a day of reckoning for investors.

New Street Research analyst Pierre Ferragu apparently has gotten the memo that the AI party isn’t some linear fashion, and last Friday, he downgraded Nvidia from a „buy” to „neutral.”

Ferragu told clients in an industry report that he was conducting a „health check” on AI stocks, indicating that shares of the AI chip leader are „getting fully valued for the base case” after soaring 154% this year, on top of 240% gains in 2023.

Many analysts have questioned whether Nvidia’s $3 trillion market cap can be maintained.

Further upside „will only materialize in a bull case, in which the outlook beyond 2025 increases materially, and we do not have the conviction on this scenario playing out yet,” Ferragu said.

While the „quality of the franchise is nevertheless intact,” there is, „if anything, a risk of derating” should the outlook remain unchanged, he added.

Ferragu noted, „Although Nvidia remains the strongest franchise for AI data centers, near-term expectations and valuation justify a more prudent view on the stock.”

He reiterated continued bullishness for Taiwan Semiconductor Manufacturing and Advanced Micro Devices, indicating both stocks have „upside in both in our base and high scenarios.”

New Street set a one-year price target of $135 for Nvidia, compared with Friday’s $125.83 close.

Data from Bloomberg shows that seven of the 72 analysts tracked have a neutral rating on Nvidia or about 9.7%. There are currently 64 buys and one sell

Ferragu said, „This doesn’t mean the end of the trend – we still see very strong growth ahead and upside potential in most names we cover,” adding, „It nevertheless means investors must now be more careful and selective in their exposure to the trend.”

Tyler Durden

Sun, 07/07/2024 – 13:25