Goldman Says War Risk Premium Is Missing From Oil Markets

Israeli Prime Minister Benjamin Netanyahu addressed the UN General Assembly in New York this morning, stating that Israel has „no choice” but to fight back against Iran-backed Hezbollah. His remarks come as tensions rise between Israeli officials and the Biden-Harris administration over the inaction this week of instituting a 21-day ceasefire-fire while Israel Defense Forces gear up for a potential ground invasion of Lebanon.

„As long as Hezbollah chooses the path of war, Israel has no choice, and Israel has every right, to remove this threat and return our citizens to their homes safely,” Netanyahu told the General Assembly, adding, „And that’s exactly what we’re doing.”

During his speech, Netanyahu showed world leaders two maps of the Middle East, pointing out the difference between a „blessing” and a „curse.”

„Now look at this second map,” he said, pointing out, „It’s a map of a curse. It’s a map of an arc of terror that Iran has created and imposed from the Indian Ocean to the Mediterranean.”

Netanyahu added: „There is no place in Iran that the long arm of Israel cannot reach – that’s true for the whole of the Middle East.”

Even with broadening war risks in the Middle East, the geopolitical risk premium in Brent crude has all but evaporated – overshadowed by economic slowdown fear in China and the US. Not even the China stimulus story earlier this week could ignite crude prices.

On Thursday, we noted the usual anonymous sources reporting by corporate media were back, and pressured Brent crude prices lower. The first report was published by Reuters earlier this month. In that report, journos cited anonymous sources that said OPEC+ was set to proceed with a production hike in October. Then an FT report on Thursday joined the anonymous-source-citing oil manipulation game with the news that the Saudis were ready to ditch the unofficial price target of $100 a barrel for crude.

Also, recent headlines surrounding a possible ceasefire in the Middle East have pressured oil prices. We must ask what exactly 'the powers that be’ are afraid of?

Maybe Goldman analyst Lindsay Matcham’s note to clients this morning shows precisely what 'the powers that be’ are afraid of…

„We’re continuing to keep a close eye on the conflict in the Middle East amid intensifying tensions between Hezbollah and Israel.”

Matcham added:

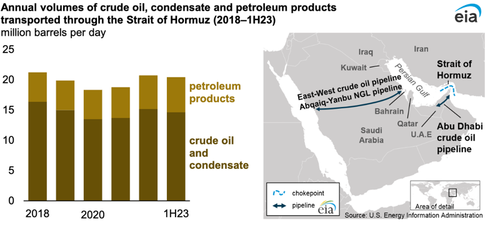

„We think further escalation in the conflict could have material market implications, especially if it involves a potential closure of the Strait of Hormuz, which would likely lead to a spike in oil prices here.”

Strait of Hormuz…

In a separate note, Goldman analyst Lina Thomas outlines four positive near-term drivers for crude markets:

-

The easing in global policy.

-

Inventories are still drawing.

-

Positioning and valuation remain low.

-

Oil markets are not pricing a significant risk of geopolitical disruptions.

Fast forward to noon today, Brent prices jumped to the mid-point of the $72 handle after IDF airstrikes targeted Hezbollah headquarters in Beirut.

Massive Israeli Airstrikes In Beirut Target Hezbollah HQ, Nasrallah https://t.co/uqp8T0VZyM

— zerohedge (@zerohedge) September 27, 2024

Broadening war risks come as speculators have placed record bearish bets in crude markets.

Brent prices hover around $72/bbl in late morning trading in the US.

The looming question for Brent traders is: When will the war risk premium return?

A potential IDF invasion of Lebanon could provoke Iran, although there are currently no signs of Tehran’s imminent closure of the Strait of Hormuz. Given the Israel-Hezbollah escalation in conflict to the end of the week, traders should monitor these events as traders hold record net-bearish bets on crude.

Tyler Durden

Fri, 09/27/2024 – 20:30