„Japan Mixed The Batter, The Fed Will Bake The Cake…”

Via SchiffGold.com,

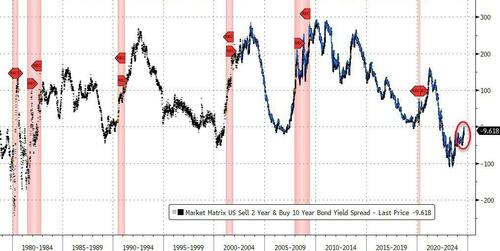

Americans are already struggling to feed their families and pay their bills, but having predicted every US recession since 1960, the steepening bond yield curve is speaking loud and clear that an “official” downturn is nearly inevitable. With bond prices on the rise as the Fed looks increasingly likely to cut rates in September, the yields are going down and the inverted curve is finally leveling out after an epic two-year inversion.

And with stocks now crashing around the world, global uncertainty is rocketing upward in a “Black Monday” event, especially as dizzyingly volatile Japan struggles to contain its post-ZIRP doom loop. In other words, the storm may be arriving in earnest.

The yield curve represents the difference in interest rates between long and short-term bonds, and every time it steepens after becoming inverted, a recession soon follows. It’s become a popular indicator because of its surgical accuracy, and because it tends to flash clear and reliable predictions before other datasets can do the same.

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Source: Bloomberg

Even the Federal Reserve admits that thus far, the yield curve crystal ball has never failed. While there are some different yield spreads that one could observe between bonds of varying maturities, recessions tend to hit when the curve flattens and the Fed cuts interest rates – precisely the current scenario.

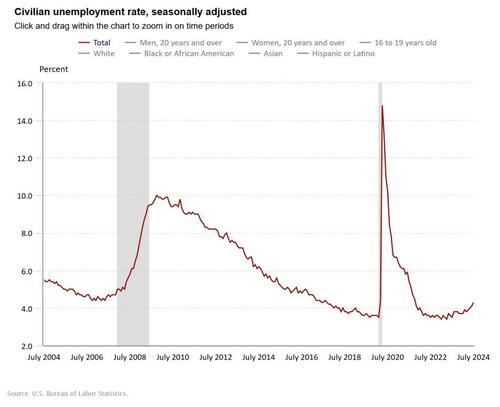

Unemployment numbers and equity prices are important as well, and last week, data showed that unemployment has gone up, triggering the “Sahm Rule” – a formula which has predicted the majority of recessions since it was devised in the 1950s by Federal Reserve alumnus Claudia Sahm.

As a general statement, unemployment has been trending upward again since 2022, in the fallout of the COVID-19 spike.

Source

For Sahm’s part, she recently published a substack post downplaying the significance of her indicator in the context of the current market, but as indicated by the yield curve and other trends, it’s far from the only warning sign.

Stock markets also flashed a sea of red last week, with Japanese stocks now tumbling further in the worst day since 1987 and the global sell-off, especially in risk assets, is intensifying. The stock market is not the economy, and as for the jobs reports, those numbers can’t be trusted — but if anything, the real employment data is even worse than indicated by official claims.

And if history is any indication, the inverted yield curve tells no lies even as government and Federal Reserve data seek to paint as rosy a picture as possible to reassure markets and continually justify the academic expertise and professional necessity of central bankers.

So does that mean we’re in for a “hard landing,” or a soft and gentle recession?

It isn’t just up to the Fed — chaos in Japan and beyond is fueling global economic chaos, forcing the Fed’s hand. The epic supply of liquidity injected into the system in the past several years has helped fuel a post-COVID asset rally, stunting the effects of the Fed’s rate hikes. But it also means that lowering interest rates now, and causing the money supply to increase even more, is increasingly likely to cause inflation to run utterly amok when consumer prices are already cripplingly-high.

However, a rate cut is all but assured now that a global sell-off is triggering panic. There’s likely to be panic either way, so the Fed might as well intervene with an emergency rate cut (or two) to try to save the system — which will, at best, kick the can down the road, and at worst, fuel further madness that ripples through the quivering world economy like a shockwave.

The Japanese implosion gives the Fed no choice but to cut, and cut hard — Japan mixed the batter, the Fed will bake the cake, and the people of the world will now have it stuffed down their throats.

Tyler Durden

Sat, 08/10/2024 – 08:10