„Lower Supply Expectations” Drive EU NatGas To Largest Monthly Gain Since August

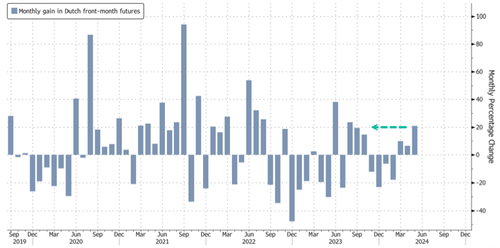

Lower supply expectations are driving European natural gas prices to their highest levels since December, with May set to record the largest monthly increase since last August.

Benchmark futures jumped 20% in May, the largest monthly increase since last August.

From a low of 23 EUR/MWh in late February, prices have surged nearly 55% to 35 EUR/MWh.

„Contracts have gained for three consecutive months as supplies have tightened, just as traders are beefing up stocks ahead of next winter,” Bloomberg said, adding that increased liquefied natural gas demand from India to Argentina means the bloc must fiercely compete in international markets after Russian NatGas flows to the EU have collapsed in recent years.

Here’s Goldman’s Samantha Dart’s take on supply woes pushing EU NatGas prices higher:

-

Lower supply expectations drive TTF higher… We saw significant volatility in TTF this past week, with prices rallying to over 35 EUR/MWh for the first time since last December, though retreating somewhat on Friday. While we have been highlighting a strong correlation between European gas and carbon emission prices, this time the TTF rally appeared to be in the driving seat, with the TTF discount to hard coal generation economics narrowing in the process (though still largely incentivizing max C2G switching, which requires TTF at a 5 EUR/MWh discount to coal). The main trigger for the move has been European gas supply concerns. Specifically, Austrian oil and gas company OMV has warned gas supply from Russia might be interrupted due to a pending court ruling that could potentially impact payments for the gas. Further, issues at Norway’s Kollsnes gas processing plant have exacerbated the impact of planned maintenance at the facility.

-

…though we believe tightening concerns are overblown. We believe that European balance tightening concerns as a result of these events are overblown. Russian flows to Austria year to date have averaged 11 mcm/d, equivalent to only 2% of our estimated NW Europe gas supply for the remainder of summer. Further, given current record-high gas storage levels in Austria, such a supply curtailment, if materialized, would not have to be fully offset by higher pipeline flows from Germany in order to manage end-summer storage levels in Austria. Gas flows this past week illustrate this point, as a week-on-week decline in Russian net volumes to Austria from 13 mcm/d to 2 mcm/d had no offsetting increase in German flows to Austria, which remained at approximately zero throughout the period.

-

European gas demand remains weak. Regarding the Kollsnes unplanned outage, while the duration of its 9 mcm/d supply impact is uncertain, this is unlikely to offset lower-than-expected gas demand this month. Weakness in both residential and power demand for gas has taken total May demand 27 mcm/d below our previous expectations, a 0.8 Bcm softening impact to storage. On net, we continue to see European storage remaining at comfortable levels, reaching mid-90s% by end-Oct

More from Dart:

Heading into summer, there is some good weather news: Europe is set for a cooler start. But should a heat dome trap the continent in an inferno – this is where prices could start rocketing higher. The EU is now at the mercy of international markets.

Tyler Durden

Sat, 06/01/2024 – 08:45