Market Pancakes As Nvidia Gamma Squeeze Fizzles, Attention Turns To Jobs, Global Easing Cycle

After yesterday’s breathless Nvidia-led meltup, which saw the AI chipmaker surpass both $3 trillion in market cap and Apple’s valuation, today’s session was a boring affair by comparison, which saw the S&P close unchanged after a day in which the index barely moved.

There were three reasons behind the lack of action.

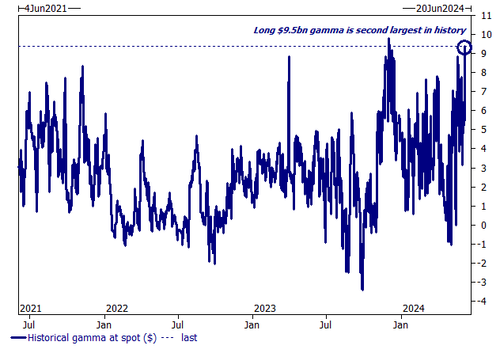

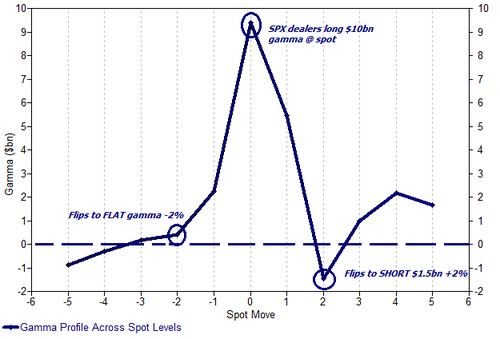

First, technicals. As Goldman’s Brian Garrett notes, ES 5350 is the „magnetized” strike, with $9.5 billion of gamma – a record amount – to trade per 100bps; This means that dealers have to sell 35,000 eminis on a 1% rally, and buy 35,000 eminis on a 1% sell off. Said otherwise, the record dealer gamma is now preventing spoos from moving too far, too fast in either direction from 5350.

Second, tech momentum died. After yesterday’s remarkable gamma squeeze in NVDA, which saw near calls explode as if the underlying was some penny stock and not a $3 trillion behemoth…

The world’s biggest company (because NVDA will surpass MSFT tomorrow) is getting gamma squeezed pic.twitter.com/b7PltycG2j

— zerohedge (@zerohedge) June 5, 2024

… an early morning „rugging” of NVDA – which saw the stock lose $175 billion in market cap just seconds after the cash close as call holders liquidated positions – crushed momentum and made sure the stunning gamma squeeze would quietly fade away.

As a result, NVDA was unable to hold on to its brand new position as the world’s 2nd most valuable company, and promptly relinquished that – and the $3 trillion market cap threshold – back to AAPL, if only for the day. Tomorrow is another day when the pre-10:1 stock split bulls will try to make NVDA the world’s biggest stock, ahead of Monday.

Third, event risk. tomorrow we get a key jobs report, now that payrolls are once again more important than inflation, and as Goldman pointed out earlier today dealers are the longest spot gamma in history, but net short the upside tail. This means that nobody is too crazy to place big directional bets ahead of a print which could see momentum ignited in either direction depending on how the NFP print comes.

Incidentally, Goldman believes that the set up into the print remains favorable for stocks, with a goldilocks NFP zone in the low 100s as stocks continue to cheer for a palatable slowdown). We think Big Data measures indicate a below-normal pace of job creation during the spring hiring season, and our layoff tracker has rebounded. Street is looking for a headline reading of +185k (GIR +160k, prior +175k

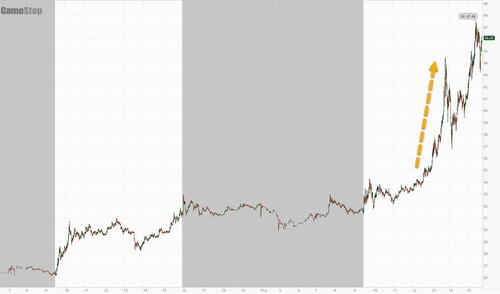

And while today was boring, with little newsflow besides the latest twit from Roaring Kitty who sent GameStock soaring more than 40% just because he announced he would have a youtube livestream tomorrow at noon…

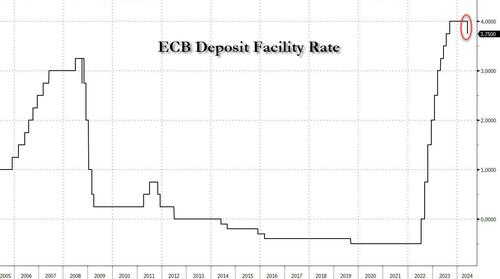

… another historic event quietly took place when the ECB became only the second G7 bank to cut rates – after a 5 year hiatus …

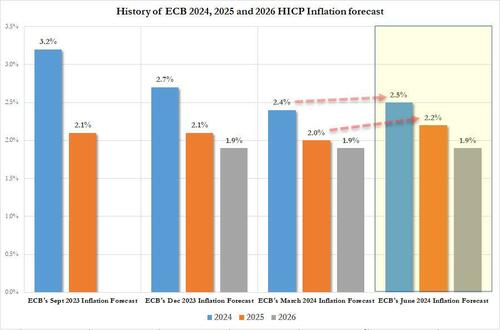

… even as the central bank raised (!) its inflation forecasts…

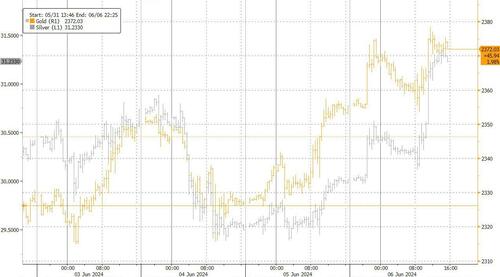

… guaranteeing that any pretense of a 2% inflation target is dead and buried, something which wasn’t lost on gold and silver, both of which have soared ever since Canada cut rates first yesterday…

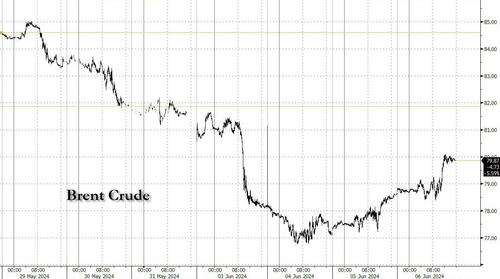

… nor was it lost on oil which has recovered a big chunk of its latest losses.

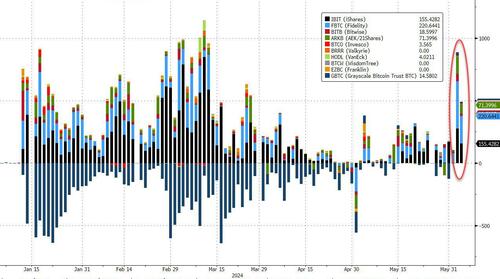

The only asset class which remained completely clueless to the return of central bank easing was – ironically – crypto, with both bitcoin and especially ethereum dumping even though traditionally they have been the best early indicators of shifting liquidity and volatility conditions. Today however, manipulation from the Jane Streets of the world and other HFT momentum igniters overcame any nascent recent bullishness…

… which will guarantee that the army of bitcoin ETF buyers – who now own 1 million bitcoin among them, leaving less than 20 million available – will just have another cheap entry point.

Tyler Durden

Thu, 06/06/2024 – 16:01