Market Snoozes As ECB Holds Rates Unchanged As Expected: „Not Pre-Committing To Particular Rate-Path”

As fully expected, The ECB decided to hold rates unchanged and gave a pretty clear statement to those looking for some strong guidance:

Here’s what it says:

“The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction.

In particular, its interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission.

The Governing Council is not pre-committing to a particular rate path.”

There’s a pretty balanced assessment on inflation, seemingly downplaying the pickup in inflation gauges in May.

On the one hand, most measures of underlying inflation “were either stable or edged down in June,” the ECB says.

On the other hand, “domestic price pressures are still high, services inflation is elevated and headline inflation is likely to remain above the target well into next year.”

🇪🇺 Two important observations in the first part of the @ecb’s statement (a clear signal):

– sticky core inflation in May was driven by „one-off factors” while „most measures were either stable or edged down in June”

– impact of high wage growth „buffered by profits” as expected— Frederik Ducrozet (@fwred) July 18, 2024

The central bank also mentioned reducing its PEPP portfolio by the second half of next year.

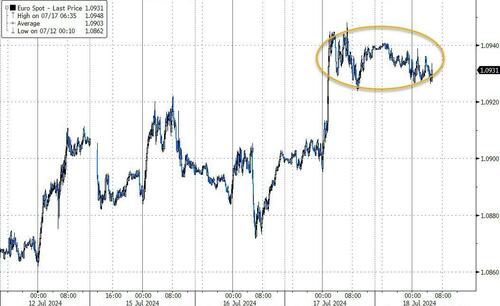

The euro was little changed against the dollar and yield curves remained largely steady after the decision… a snoozer…

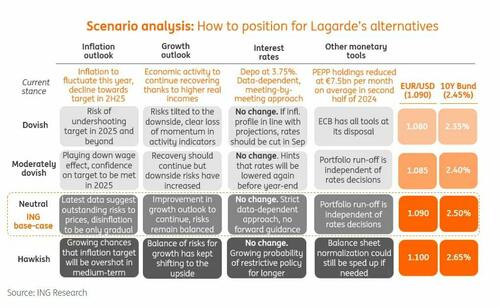

All eyes and ears now shift to the press conference for hints that the ECB will cut again in September, when the ECB will also issue new staff projections for growth and inflation.

As we laid out earlier, here are the scenarios if Lagarde drops any hints…

Watch Lagarde’s press conference live here (due to start at 0845ET)

Read the full statement below:

Monetary policy decisions

The Governing Council today decided to keep the three key ECB interest rates unchanged. The incoming information broadly supports the Governing Council’s previous assessment of the medium-term inflation outlook. While some measures of underlying inflation ticked up in May owing to one-off factors, most measures were either stable or edged down in June. In line with expectations, the inflationary impact of high wage growth has been buffered by profits. Monetary policy is keeping financing conditions restrictive. At the same time, domestic price pressures are still high, services inflation is elevated and headline inflation is likely to remain above the target well into next year.

The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction. In particular, its interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

Key ECB interest rates

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 4.25%, 4.50% and 3.75% respectively.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The APP portfolio is declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

The Eurosystem no longer reinvests all of the principal payments from maturing securities purchased under the PEPP, reducing the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

Refinancing operations

As banks are repaying the amounts borrowed under the targeted longer-term refinancing operations, the Governing Council will regularly assess how targeted lending operations and their ongoing repayment are contributing to its monetary policy stance.

***

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its 2% target over the medium term and to preserve the smooth functioning of monetary policy transmission. Moreover, the Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

Tyler Durden

Thu, 07/18/2024 – 08:24