Nike Shares Slide On Biggest Sales Drop In Years, Guidance Withdraw, Investor Day Postponed

Nike shares fell in premarket trading in New York after the sportswear company withdrew its full-year sales guidance and postponed its investor day, which was slated for November, as new leadership enters the picture in less than two weeks.

Last month, CEO John Donahoe revealed that Nike veteran Elliott Hill would succeed him on October 14. With the leadership shift less than two weeks away, the company pulled its full-year guidance and will instead provide quarterly updates for the remainder of the year.

„This provides Elliot with the flexibility to reconnect with our employees and teams, evaluate the current strategies and business trends and develop our plans to best position the business for fiscal ’26 and beyond,” CFO Matthew Friend told Wall Street analysts on an earnings call yesterday.

Friend said Nike will adopt a new strategy to increase market share in running shoes and clothes.

„Nike’s a running company, Nike’s a running brand and it’s incredibly important for Nike to win with runners,” the CFO said, adding, „And so our commitment to reinvesting in those channels with those partners on the ground every day is how we’re going to change the trajectory of this business.”

He noted: „We’ve acknowledged that we’ve lost market share in the running specialty channel. More than four years ago, we pulled back on our engagement with that channel, and as a result of that, we saw market share losses….While we’ve seen tremendous success at the top of the pyramid, with innovation, with marathons and on the track, we haven’t made as much progress with everyday runners and that’s where our team’s focus and attention has been over the last year.”

Here’s more insight from a team of Goldman analysts, led by Brooke Roach and Evan Dorschner, regarding Nike’s decision to withdraw its full-year sales guidance:

FY25 outlook withdrawn: NKE withdrew its FY25 outlook given the recent CEO transition, with prior guidance for revenues to decline -MSD% (vs. GS/consensus at -5.0%/-5.4%), gross margins to expand 10-30bps Y/Y (vs. GS/consensus at 30bps/40bps expansion), and SG&A up slightly Y/Y (vs. GS/consensus +1.1%/+0.2%). That said, the company provided some additional color on their expectations for the balance of the year. NKE noted their expectations for revenue have softened since the start of the year given challenging NKE digital traffic trends, pressured retail sales trends across the industry, and Spring 2025 order books coming in slightly below expectations at ~flat Y/Y. The company is still seeing indications of a slight 2H improvement in revenue trends vs. F1H, largely as a result of scaling new product innovations. The company expects franchise management actions will remain a -MSD% headwind for the balance of the year. On margins, the company now expects gross margins to contract Y/Y and intends to tightly control SG&A costs, with investments in driving brand momentum offset by well-controlled operating costs. Separately, Nike also postponed their previously announced Investor Day.

The analysts continued:

Ahead of the quarter, our conversations with investors suggested a guidance cut was expected as a result of concerns regarding the achievability of a near-term inflection in sales growth amidst choppy China macro data. Today we did see this withdrawal of NKE’s FY guide (now moving to quarterly guidance), with commentary on key line items confirming a below-consensus run-rate for the business. NKE also postponed its previously announced Investor Day. Here, management attributed the change in both guidance philosophy and Investor Day timing to the CEO transition. We believe the company’s commentary in aggregate was weaker than expectations for both F2Q and the year, and we expect the stock to underperform peers as a result.

They added:

We lower our estimates and price target to reflect weaker margins and a slower pace of recovery in sales and profits. We acknowledge the path ahead for NKE is choppy, and the company is still in the early stages of a turnaround as it continues to work through franchise rebalancing as it scales into better innovation-led growth. However, we see a path to stronger results ahead, as we expect FY25 to mark a nadir in sales and profitability. NKE is working through its over reliance on key franchises this year, which weigh on sales and profitability, and as we enter FY25 we believe NKE is better-positioned as the company is beginning to see key greenshoots emerge in new product categories which are continuing to scale. Importantly, the company would also benefit from new leadership (incoming CEO arriving October 14), which is likely to bring opportunity for clarity of strategy, as well as benefits from a re-focused innovation pipeline.

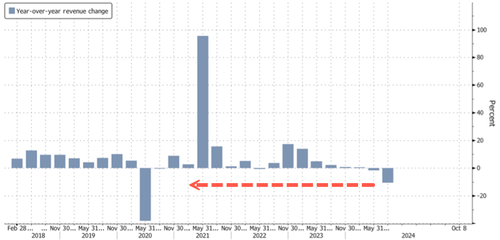

The first-quarter earnings showed earnings per share of 70 cents, higher than the GS/FactSet consensus of 51 cents/ 52 cents. However, sales were down 10% compared with the same period last year.

NKE reported F1Q25 EPS of $0.70, above GS/FactSet consensus at $0.51/$0.52. Sales of $11.589bn declined -10.4% Y/Y (down -9% ex-FX), better than GSe at -10.5%, but below consensus expectations at -10.1%. Within this, sales were above consensus in North America, Greater China, and APLA, although EMEA sales fell below consensus. Gross margin at 45.4% came in above GS/consensus at 44.5%, with the ~120bps of expansion driven by favorable product costs, warehousing and logistics cost tailwinds, and lapping prior year discounting. NKE’s SG&A rate was 34.9% of sales, well-controlled vs. GS/consensus at 37.1%/37.0%. Net, adjusted EBIT margin of 10.9% beat GS/consensus expectations of 7.7%/7.6%.

Whoops!

CFO Friend told analysts: „A comeback at this scale takes time, and while there are some early wins, we have yet to turn the corner.”

Here’s additional commentary from analysts, courtesy of Bloomberg:

BMO Capital Markets analyst Simeon Siegel (outperform, PT $92)

- Nike’s margin-driven profit beat offset the soft 1Q sales

- „With quantitative fears now addressed, we expect shares to be driven more so by qualitative imaginings of what can be”

Truist Securities analyst Joseph Civello (hold, PT cut to $83 from $85)

- Nike reported 1Q sales slightly below estimates and EPS beat „depressed expectations”

- Cautious on near-term turnaround opportunities, given the lighter wholesale orderbooks for next Spring

Piper Sandler analyst Anna Andreeva (neutral, PT $80)

- Back-to-school sales were weaker than expected, even though traffic improved in August

- The company’s move to pull the annual guide and postpone its Investor Day is „prudent”

Jefferies analyst Randal Konik (hold, PT $85)

- A lot of changes need to take place at Nike, „in the meantime market share losses are likely to continue”

- Gross margin gains will soften as promotions and discounts increase — „the EPS deck is no where near being cleared”

Bloomberg Intelligence analyst Poonam Goyal

- Nike’s underperformance when compared to the broader athleisure market may continue into fiscal second quarter

- „Fiscal 2Q gross margin may fall about 150 bps on higher discounts and channel mix shifts”

Shares in premarket trading are down around 5.5%. On the year, shares are down nearly 18% and hovering around Covid lows.

Goldman analysts rate Nike as a „Buy” for clients. Here’s why:

We are Buy rated on NKE. We update our FY25/FY26/FY27 EPS estimates to $2.81/$3.16/$3.67 from $3.24/$3.75/$4.26 prior to reflect slower global demand trends and additional margin pressures, including higher promotions, where we now expect a slower rate of revenue recovery into FY26 vs prior and a slower pace of margin recapture. We lower our 12-month price target to $97 from $105 prior as we roll forward our Q5-Q8 EV/EBITDA valuation methodology on our updated estimates, and raise our target valuation multiple to 21.0x from 19.75x prior to reflect market multiple rerating and a stronger growth outlook moving forward following what we believe to be trough demand levels, alongside increased confidence in turnaround potential from new management.

Downside risks:

Key downside risks include: (1) China macro slowdown; (2) An intensification of sportswear market competitive intensity or lack of success of new product innovation; (3) Wholesale channel pressures; (4) Inventory management and promotionality; (5) Slower recapture of transitory margin pressures.

Cancelling investor day next month was not a good look for the world’s largest sportswear company.

Tyler Durden

Wed, 10/02/2024 – 07:45