„Numbers Aren’t Jiving To The Real World” – Huge Revisions Leave Traders Questioning Biden Admin’s Energy Data

Just over a year ago, we commented on the „massive” revisions that the statistical arm of Biden administration’s Department of Energy – the Energy Information Administration (EIA)…

The Biden admin will not stop fabricating data and draining the SPR to push the price of oil lower https://t.co/mxYq4hyCnY

— zerohedge (@zerohedge) June 30, 2023

Adding to those who questioned the 'fabrication’ that:

When is the last time demand estimates were revised lower

— zerohedge (@zerohedge) June 30, 2023

Zoom forward a year and the 'revisions’ across multiple (government-supplied) macro data items are now well known and widespread… and statistically noteworthy that the revisions tend to be negative (implying the initial data was 'optimistic’)…

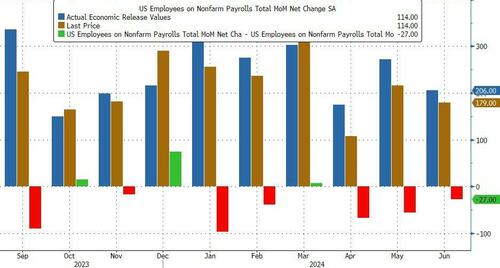

Payrolls (7 of the last 10 months have seen downward revisions)…

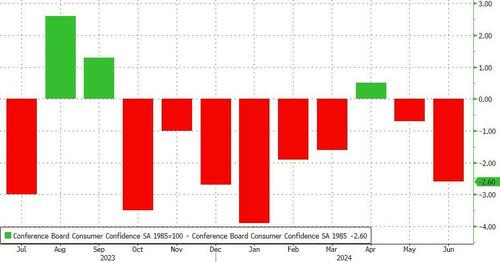

Consumer Confidence (9 of the last 12 months have seen confidence revised lower)…

The situation has become so widespread that even the mainstream media is forced to admit that there is something odd going on.

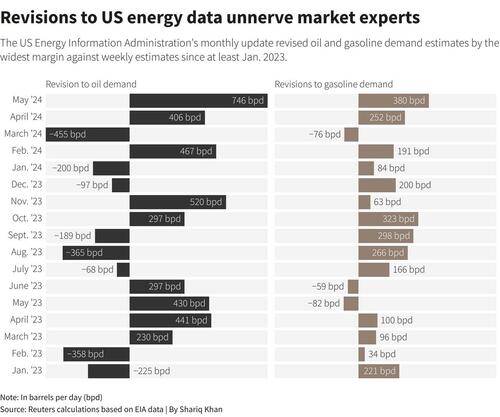

Specifically, circling back to our initial thoughts, Reuters reports this morning that a string of dramatic revisions to official U.S. oil consumption data have unnerved market participants who rely on the figures to trade.

The EIA published a monthly update last week that showed U.S. oil consumption at a seasonal record in May as motorists burnt more gasoline than even before the pandemic.

That data conflicted with weekly updates published that month showing oil and fuel demand struggling to even match last year’s levels.

The EIA says the weekly figures for May were off because preliminary readings overestimated gasoline output and undercounted exports. The agency does not expect weekly estimates to be as accurate as monthly data, but to be consistent in showing general trends.

Of course it just happens that the initially 'weak’ demand figures helped lower crude and gasoline prices at a time when inflation was rearing its ugly head once again and Bidenomics was hitting the wall. And as is the case with payrolls revisions (or consumer confidence), traders reactions to the revisions are dramatically less sensitive than they are to the original prints.

However, as Reuters reports, these discrepancies (we are being polite) are starting to make market participants question the version of reality they are being sold.

„It makes you wonder why anyone is paying attention to the weekly numbers,” said Tom Kloza, head of energy analysis at Oil Price Information Service (OPIS). Many fuel marketers have expressed disbelief over the revisions the EIA made to its numbers in May, he added.

A trader at one of the largest commodities distribution firms said the revisions left them befuddled, and warned such changes could ultimately hurt consumers as decisions on how much fuel to import are influenced by the EIA data.

„It’s a trend that’s a little concerning to me,” GasBuddy analyst Patrick De Haan says.

„The EIA has been the bedrock for analysts, but skeptics may be gaining more validity to arguments that the EIA numbers aren’t jiving to the real world.„

Since when did the 'real world’ have anything to do with macro data during an election year?

Tyler Durden

Thu, 08/08/2024 – 15:00