Pensive Powell & Hawkish 'Dots’ Spoil Markets’ Soft-CPI Party

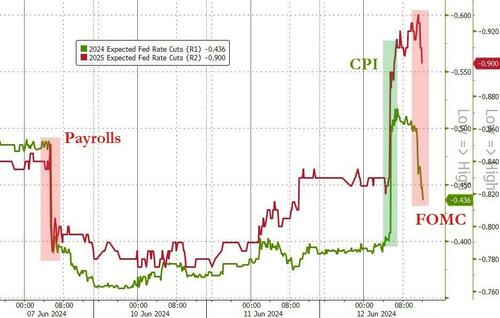

Soft CPI (bad data?) sparked a melt-up in stocks, bonds (prices), gold, and crypto which held in place until The Fed statement (more specifically the dotplot) which sent a more hawkish message to markets than was expected.

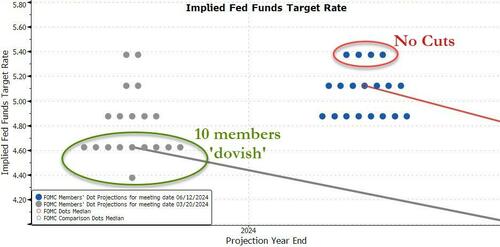

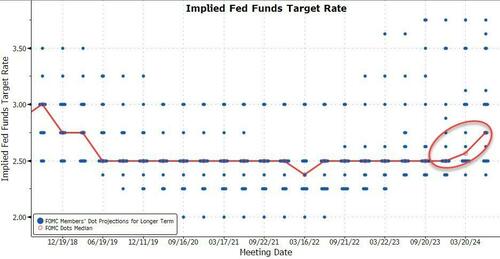

There were 10 Fed members who saw rates at 4.625% or below by end 2024 (at least 3 cuts) in March… now there are none…

June Dots summary:

-

No Cuts: 4 (2 in March)

-

1 Cut: 7 (2 in March)

-

2 Cuts: 8 (5 in March)

-

3 Cuts: 0 (9 in March)

-

4 Cuts: 0 (1 in March)

The initial reversal shock of the hawkish statement was quickly stymied by Powell’s press conference where he shrugged off the dots and left the door open for cuts…

-

POWELL: FED PROJECTIONS AREN’T A PLAN, THEY CAN ADJUST

-

POWELL: WE ARE PRACTICING A SLIGHT ELEMENT OF CONSERVATISM ON OUR INFLATION OUTLOOK

-

POWELL: WE’RE ASSUMING GOOD BUT NOT GREAT INFLATION NUMBERS

-

POWELL: WE WELCOME TODAY’S INFLATION READING, HOPE FOR MORE

But most notably, as Jeff Gundlach pointed out, Powell was considerably more „on the fence” than he has been before…

Powell seems to consider the balance of risks a lot more, well, balanced. He mentioned more than once the risk that the job market could give way suddenly and sharply.

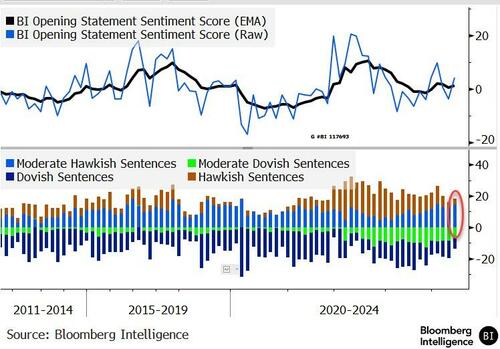

Bloomberg’s natural language processing model showed that Powell’s opening remarks were right at neutral after being modestly dovish in May.

“Our ear test considered Powell slightly more hawkish than the May opening remarks, but very marginally,” BI’s Jersey says.

“Our NLP model confirmed this ear test, so it’s not surprising the front end of the market has sold off a bit listening to Powell.”

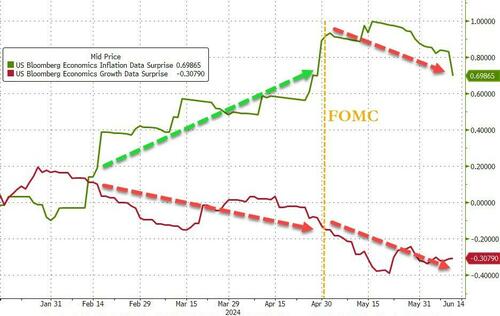

Today’s soft CPI (bad data) sent the inflation surprise index lower…

Source: Bloomberg

The soft CPI sent rate-cut expectations soaring but the FOMC Dots sparked a reversal (mostly in the 2024 expectations)…

Source: Bloomberg

Stocks followed a similar (if not delayed) path as the FOMC statement dented the post-CPI spike (with Small Caps seeing a massive short squeeze higher). Powell was unable to keep the soft-CPI dream alive during his press conference as he so often does. The Dow was the day’s laggard

Source: Bloomberg

AAPL once again saw an utterly irrational panic bid at the US cash open (as buybacks continued)…

Source: Bloomberg

Here’s Goldman’s trading desk:

Our buyback desk is currently running at 1.6x ytd daily avg notional executed. Extrapolate this to the entire street pacing at over $7b of vwap type of demand today. The biggest are getting bigger.

…but as we noted at the top, it seems the buyback dollars have run out…

did the buyback run out of $? https://t.co/AjeyVGMfaZ

— zerohedge (@zerohedge) June 12, 2024

The small reversal in AAPL at the close pulled it bac below the market cap of MSFT after being above it most of the day. There are now once again three companies with market caps above $3 trillion (MSFT $3.28tn, AAPL $3.27 tn, NVDA, $3.05 tn)

As Academy Securities’ Peter Tchir noted, we learned more from CPI than from The Fed…

CPI sparked a rally in bonds and stocks this morning that lasted until the Fed.

The “dots” pushed one rate cut from this year into next. Largely expected, especially since the dots didn’t have today’s CPI print.

Powell, apparently, wasn’t as dovish as market had priced in as stocks and bonds both gave up some gains as the press conference ended.

He did seem to focus more on jobs than inflation (makes sense as avoiding a recession in an election year is likely high on his priority list). The media and Powell seemed as confused by Friday’s job report as we were. He seemed to talk about longer term averages, etc. But he didn’t mention the discrepancy has been pretty consistent, the birth/death model is disproportionately large, or the massive amount of part-time vs full-time jobs. Takeaway was jobs cooling but not problematic, but the Fed is prepared to react if job market weakens.

Not quite “mission accomplished” on the inflation front but almost. I was confused on rent increase lags (and still don’t understand why we don’t have something remote,y resembling real-time, market based data, for that). Also it seems to be clear if we are high because of lags, the real inflation problems were much higher than official reports (why surveys show inflation as bigger problem than 3% would indicate)

Away from that, AI seems the big story, yet again! NVDA and AAPL up 3% and ORCL a cool 13%!

I do think bond yields can trade higher from here 4.3% to 4.5% has been a great trading range. Shift will focus to the deficit and the “successful” auction bounce we had on 10s makes limited sense to me. We will have auctions week after week, month after month, with no indication size of auctions will do anything but grow over time.

It would be nice to see the underperformers catch up or take leadership, but seems like the narrow leadership continues.

Treasury yields were dramatically lower today with the belly of the curve outperforming. This shift erased all of the post-payrolls spike in yields..

Source: Bloomberg

Notably, we saw the long-term neutral rate rise for the second quarter…

Source: Bloomberg

The dollar ended the day lower but reversed a lot of the early CPI losses after the hawkish dots…

Source: Bloomberg

Bitcoin surged back up to $70,000 on the CPI print then reversed all the gains on the dots…

Source: Bloomberg

Interestingly BTC and AAPL dumped together on the FOMC dots but AAPL barely budged on the CPI data while BTC ripped (it’s not the AI, stupid, it’s the buybacks)…

Source: Bloomberg

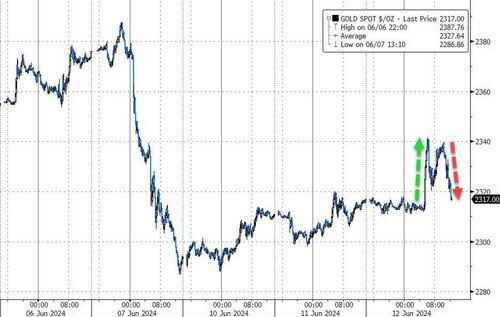

Gold ended unchanged after CPI gains were erased…

Source: Bloomberg

Oil prices ended higher on the day but off their highs above $79 (WTI) after tumbling on the DOE inventory builds,basically retracing the post-API crude draw gains…

Source: Bloomberg

Finally, the last month has seen the post-Powell-pivot trend of stronger-hard-data and stocks has now completely broken…

Source: Bloomberg

Will today’s reality check from The Fed’s 'DOTS’ punch stocks in the face?

Tyler Durden

Wed, 06/12/2024 – 16:00