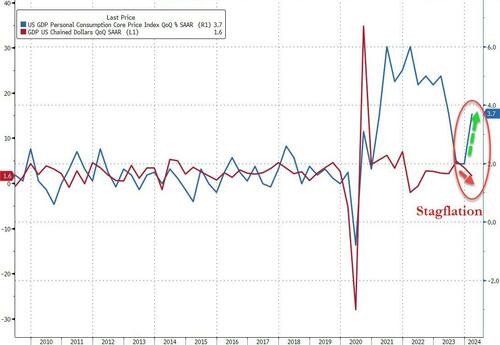

’Stagflationary’ GDP Data Sparks Market Turmoil, Rate-Cut Hopes Crushed

Weaker than expected growth and hotter than expected prices… the perfect example of a central banker’s nemesis: Stagflation…

…and the market is very unhappy about it.

Olu Sonola, head of US economic research for Fitch Ratings:

“The hot inflation print is the real story in this report. If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

Rate-cut expectations have dropped back near cycle lows (for 2024 and 2025)…

Source: Bloomberg

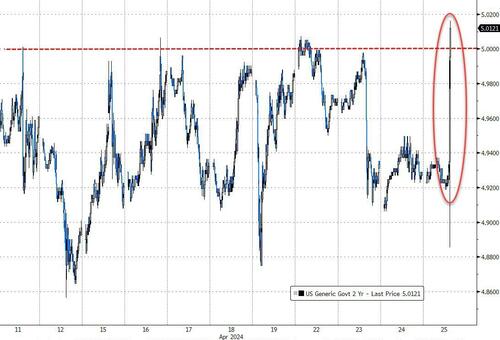

Treasury yields are soaring, led by the short-end…

Source: Bloomberg

With 2Y back above 5.00% (will it hold)…

Source: Bloomberg

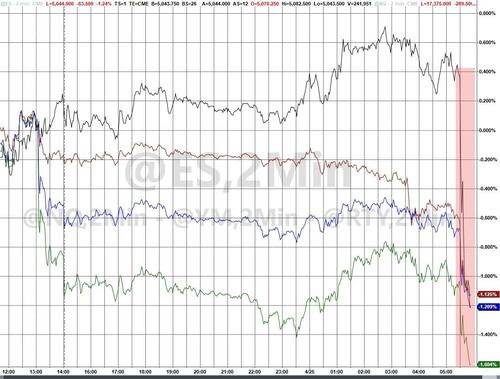

Stocks are getting spanked…

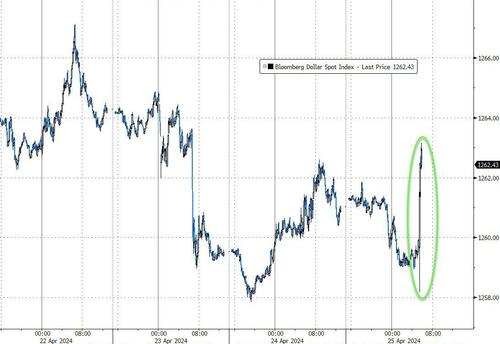

Commodities are less anxious with oil sliding a little, gold rallying modestly even with the dollar rising…

Source: Bloomberg

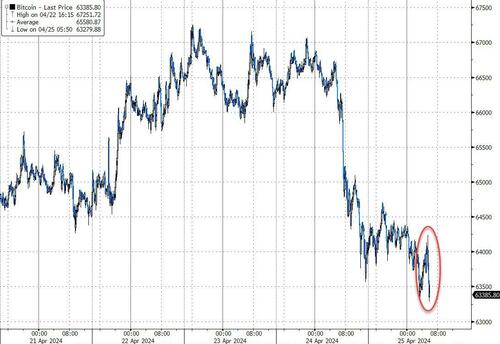

Crypto is heading lower…

Source: Bloomberg

What time is the Biden press conference to confirm there will be rate-cuts this year?

Tyler Durden

Thu, 04/25/2024 – 09:00