Stellar 30Y Auction Sends 10Y Bond Yield To Three Month Low

After a subpar, tailing 3Y and a solid, stopping through 10Y auction earlier this week, moments ago we got the week’s final coupon auction when the Treasury sold $22BN in 30Y paper in a reopening of Cusip UA4 (so technically it was a 29-Year, 11-Month auction) in what can only be described as a stellar auction.

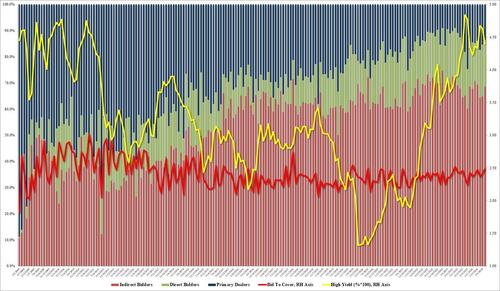

The high yield of 4.403% was the lowest since March (and well below last month’s 4.635%) and also stopped through the When Issued 4.418% by 1.5bps, the 2nd consecutive stop through in a row.

The bid to cover was 2.486, up from 2.409 in May and the lowest since June 23, signaling very strong demand.

The internals were also stellar with Indirects awarded 68.5%, up from 64.9% in May, the highest since March and above the six-auction average of 67.6%. And with Directs awarded 17.8%, the lowest since March, Dealers were left holding just 13.7%, the lowest since last August.

The stellar auction sparked a fresh round of bond buying and sent 10Y yields not only to session lows of 4.22%, but also to the lowest level since the end of March, which means that the 10Y is now almost 50bps from the most recent high of 4.70% hit in late April.

Tyler Durden

Thu, 06/13/2024 – 13:17