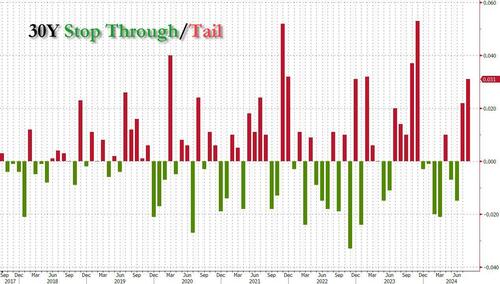

Ugly 30Y Auction Has Biggest Tail Since November

After yesterday’s dire 10Y auction, which sent yields surging and stocks tumbling, the last thing the market needed was another debacle of an auction, but that’s precisely what it got moments ago when today’s 30Y auction tailed by 3.1bps, the exact same as yesterday’s 10Y sale, and predictably yields spiked after both.

Stopping at a high yield of 4.314%, today’s sale of $25 billion in 30Y paper saw the lowest yield since January’s 4.229% and was down sharply from the 4.405% in July. And, like last month, today’s auction tailed and by a substantial amount: with the When Issued trading at 4.283%, this was the biggest tail since November.

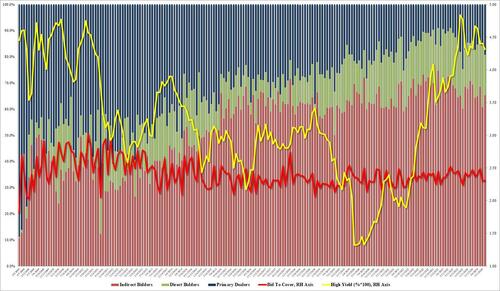

The Bid to Cover was also in line with last month: at 2.308, it was right on top of last month’s 2.299 if below the six-auction average of 2.406.

The internals were a modest improvement to last month, with Indirects taking 65.3%, up from last month’s 60.8%, but below the 6-auction average 66.4%. And with Directs awarded 15.5%, or also well below the recent average of 18.4%, Dealers were left holding 19.2%, the highest since last November.

Overall, this was another ugly auction, with the one redeeming quality perhaps being that yields have tumbled in recent days, which is why buyers in the second market were few and far between, and are merely waiting for bond prices to retrace some more of their recent gains before they step in.

Tyler Durden

Thu, 08/08/2024 – 13:21