Chinese Steel Industry Warns Of 'Flash In A Pan’ Recovery If Mills Ramp Production Amid Severe Slowdown

The official journal of China’s metals industry was correct late last month when it called the 10% jump in iron ore prices that breached $100/ton „irrational” and „lacked fundamental support.” Now, prices trend around the $90/ton handle as China’s top steel industry group warned mills to be cautious in boosting output.

Goldman’s Rich Privorotsky told clients this morning, „Iron ore is dropping to 90, China will continue to struggle, and commodities as a whole, I think, are reflecting the downgrade to growth expectations in the geography.”

The China Iron & Steel Association released a memo (first published by Bloomberg) to industry insiders this week, indicating, „There will be a certain degree of recovery in steel demand through September and October, which is favorable for the steel market.”

„However, we need to be cautious of the impulse to restart production,” the association said, adding the risk of too much steelmaking material output could dampen „any improvement in the situation will end up a flash in the pan.”

China’s steel industry has been under pressure amid a severe property market downturn and weak economic recovery. Last month, Baowu Steel Group Chairman Hu Wangming warned that economic conditions in the world’s second-largest economy felt like a „harsh winter.”

As the world’s largest steel producer, Baowu Steel’s chairman said the steel industry’s downturn could be „longer, colder, and more difficult to endure than expected,” potentially mirroring the severe downturns of 2008 and 2015.

This should serve as a major wake-up call for macro observers that a recovery in China isn’t imminent; in fact, Beijing might not unleash the monetary and fiscal cannons until after the US presidential elections.

In recent weeks, Goldman analysts led by Aurelia Waltham and Daan Struyven said iron ore’s „fundamental outlook remains bleak”:

-

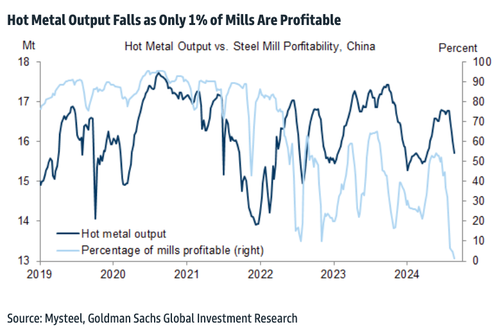

The fundamental outlook remains bleak, in our view. While both port and in-plant iron ore stocks declined this week, visible stocks remain elevated compared to 'normal’ August levels and mills’ destocking (despite the drop in iron ore prices) could be an indication of a negative production outlook. This would not be surprising given only 1% of Chinese steel mills are currently profitable, according to a Mysteel survey.

-

Meanwhile, our China property team have cut their forecasts for gross floor area starts and completions for 2024, and our China economists have highlighted rising downside risk to Chinese growth, both of which could have negative implications for steel demand, discussed in this week’s Macro Highlight.

-

In the absence of a hot metal output recovery, continued strong iron ore supply means that we maintain the view that iron ore needs to remain below $100/t for long enough to trigger a sufficient supply response to re-balance the market.

Here’s the most stunning chart from the report. It shows that only 1% of steel mills in China are profitable. As profitability collapses, hot metal output declines.

A separate Goldman note published earlier this week warned the Chinese steel industry downturn has created a „challenging environment for iron ore.”

The drop in Chinese rebar and hot-rolled coil prices to their lowest levels since 2017 signals the storm clouds continue gathering above, suggesting that a broader recovery won’t occur this year.

The broader commodities complex has been plagued by China slowdown fears, with Brent crude sliding to $73/bbl – ignoring Eastern Europe and Middle East war risks.

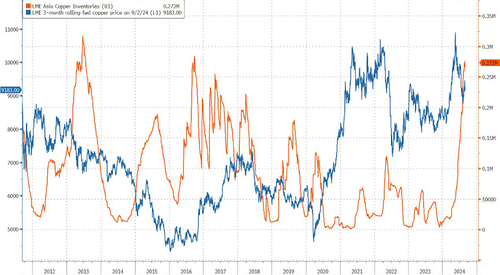

Copper has also faded from record highs, with Goldman slashing its 2025 price forecast by nearly $5,000 earlier this week.

LME Asia copper inventories have surged to the highest levels since 2016.

Even veteran commodities analyst Jeff Currie dialed back his super bull thesis on the base metal because of mounting economic woes in China.

With the Bloomberg Commodity Index sliding and JPM Global Manufacturing PMI sub 50 in contraction…

… Zhao Liang, head of research at GF Futures Co, summed up the environment for Bloomberg in an interview: „The fundamental picture supports the slide in. Overall, it’s due to weak steel demand—people are pessimistic.”

Tyler Durden

Fri, 09/06/2024 – 04:15