Hedge Funds Split Over Stocks’ Move From Here

Authored by Simon White, Bloomberg macro strategist,

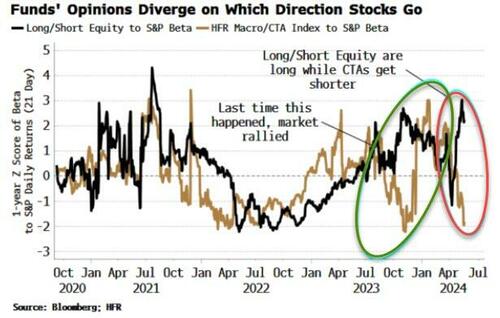

CTAs are getting shorter the stock market while long/short equity funds have been getting longer.

The last time this happened, in November, long/short funds were positioned correctly, with the market rallying over the next five months.

CTAs, or managed futures strategies, typically use trend-following systems to go long or short a variety of equity, bond and commodity futures. Using the S&P 500 as a proxy for overall risk, CTAs (based on, for example, HFR’s index of CTA funds or the DBi Managed Futures ETF) have become more negatively sensitive to the index.

That means they should lose money if the S&P continues to rally (if they stay similarly positioned).

Long/short equity funds buy and sell stocks they perceive as under or overvalued. Their returns have been enhanced in the higher-rates environment, given their shorts typically fund most of their longs, thus they can invest the remaining cash in T-Bills.

Long/short funds’ sensitivity to the S&P is becoming more positive. As the chart below shows, the two fund styles are generally in agreement in which direction they expect stocks to go.

The last time there was such a divergence in views was November, when the market rallied strongly – with CTAs likely boosting the rise – covering their shorts and soon becoming long.

The data indicates that long/short funds will be vindicated again.

The ingredients for a deep correction are not there at the moment.

Overall, near-term recession risk remains low, removing – again, for now – one of the biggest dangers for stocks. However, some soft data has deteriorated enough, while the hard data is still sufficiently fragile, meaning the risk of a recession could rise very quickly, i.e. more nimbleness in positioning is probably best.

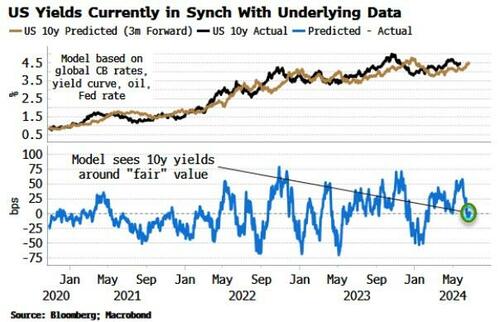

Yields look around fair value, so there are no immediate and obvious ex ante catalysts why stocks should be knocked back by a bond selloff.

Excess liquidity remains supportive for the equities.

It’s conceivable the market keeps grinding higher in the coming weeks, squeezing any CTAs who may be outright short equities (or other assets negatively correlated to the stocks).

Tyler Durden

Tue, 05/28/2024 – 10:20