Key Events This Week: Core PCE, Presidential Debate And French Election

The French snap election on Sunday (part one) will be the main event this week with weekend opinion polls showing support for Le Pen’s National Rally continuing to edge up with the latest poll of polls showing support at 33%, versus the 27% for the far-left New Popular Front (NPF) and 20% for Macron’s movement. As an interesting aside, DB’s Jim Reid notes that one of the NPF members Eric Coquerel, who was chair of the finance committee prior to the dissolution of parliament two weeks ago, said that his party’s alliance would raise the top marginal rate of income tax to 90% if it were elected. The top rate is currently 45%. While the constitutional court may well prevent this if they were in power, it is more evidence of the potential consequences of this election.

Staying with politics, it will also be fascinating to see the first televised debate between Biden and Trump on Thursday evening in the US. There is plenty of scope for big headlines and for the candidates to gather some momentum or see it go into reverse.

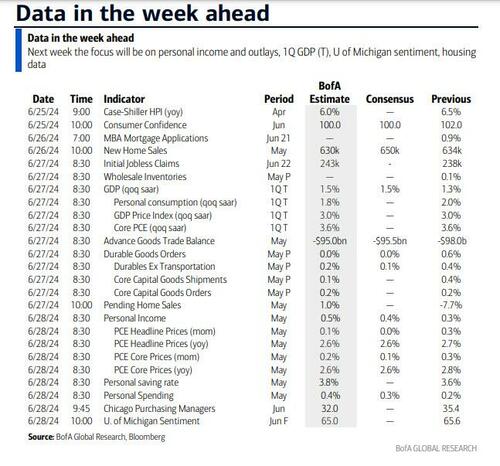

In terms of data the main event is Friday’s US core PCE. Friday is also a big day for inflation in Europe where we get the flash CPI shortly after the Tokyo CPI in Japan is released earlier in the day.

Other highlights this week by day are the German IFO today; US consumer confidence, Japan PPI, Canadian CPI tomorrow; US new home sales, Australia CPI and a 5yr UST auction on Wednesday ; US trade, durable goods, and a 7yr UST auction on Thursday; and with Friday bringing German unemployment, and the final UoM US consumer sentiment alongside the inflation data mentioned above. The day-by-day calendar at the end gives a fuller dairy of events.

Previewing Friday’s US core PCE deflator, DB’s economists believe it should increase +0.17% (vs. +0.25% previously), which would have the effect of lowering the year-over-year rate by 12bps to 2.63%. One note of caution is that their estimate does not include the -10.2% plunge in the seasonally-adjusted PPI for international scheduled passenger air transportation. Their estimate would be about 5bps lower if the BEA does not smooth through this drop. Thus, risks are skewed to the downside which is certainly one to watch.

Moving on to European inflation, our European economists’ inflation previews Friday’s flash releases here.They expect Eurozone HICP to come in at 2.40% YoY (2.57% in May). Across countries, their forecasts are 2.4% (2.8%) for Germany, 2.5% for France (2.6%), 0.8% for Italy (0.8%), and 3.4% for Spain (3.8%).

Another thing to watch is Nvidia and tech. Nvidia became the largest company in the world on Tuesday night before Wednesday’s holiday. It then opened over 3% higher on Thursday. However from this peak it fell around -10% into Friday’s close. Is this a brief hiccup, or the start of some air being let out of the ballon?

On the earnings front, investors will be looking at the latest reports from Fedex (Tue), Micron (Wed) and Nike (Thu).

Courtesy of DB, here is a day-by-day calendar of events

Monday June 24

- Data : US June Dallas Fed manufacturing activity, Germany June Ifo survey

- Central banks : BoJ summary of opinions (June MPM), Fed’s Waller and Daly speak, ECB’s Nagel, Villeroy and Schnabel speak

Tuesday June 25

- Data : US June Conference Board consumer confidence index, Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, Richmond Fed business conditions, Dallas Fed services activity, May Chicago Fed national activity index, April FHFA house price index, Japan May PPI services, Canada May CPI

- Central banks : Fed’s Cook and Bowman speak, ECB’s Stournaras and Nagel speak

- Earnings : FedEx, Carnival

- Auctions : US 2-yr Notes ($69bn)

Wednesday June 26

- Data : US May new home sales, Germany July GfK consumer confidence, France June consumer confidence, Australia May CPI

- Central banks : ECB’s Rehn, Panetta, Lane, Kazimir and Kazaks speak

- Earnings : Micron

- Auctions : US 2-yr FRN (reopening, $28bn), 5-yr Notes ($70bn)

Thursday June 27

- Data : US May advance goods trade balance, wholesale inventories, retail inventories, durable goods orders, pending home sales, June Kansas City Fed manufacturing activity, initial jobless claims, China May industrial profits, Japan May retail sales, Italy June consumer confidence index, manufacturing confidence, economic sentiment, May PPI, Eurozone May M3, June services confidence, industrial confidence, economic confidence

- Central banks : BoE’s financial stability report, Riksbank decision

- Earnings : Nike, H&M

- Auctions : US 7-yr Notes ($44bn)

Friday June 28

- Data : US May personal income, personal spending, PCE, June MNI Chicago PMI, Kansas City Fed services activity, UK June Lloyds Business Barometer, Q1 current account balance, Japan May jobless rate, job-to-applicant ratio, industrial production, housing starts, June Tokyo CPI, Germany June unemployment claims rate, May import price index, France June CPI, May consumer spending, PPI, Italy June CPI, April industrial sales, Canada April GDP

- Central banks : Fed’s Barkin and Bowman speak, ECB consumer expectations survey, Villeroy speaks

Finally looking at just the US, Goldman notes that the key economic data releases this week are the durable goods report on Thursday, and the core PCE and University of Michigan reports on Friday. There are several speaking engagements from Fed officials this week including Governor Waller on Monday and New York Fed President Williams on Sunday.

Monday, June 24

- There are no major economic data releases scheduled.

- 03:00 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will give opening remarks at the International Journal of Central Banking Annual Research Conference 2024 in Italy. Speech text is expected. On May 21, Waller said “If we get enough data going the right way, then we can think about cutting rates later this year, beginning of next year.”

- 02:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will give remarks on monetary policy and the economy, followed by a moderated Q&A. Speech text is expected. On April 15, Daly said “the worst thing to do is act urgently when urgency is not required” and “[we] need to be confident that inflation is on the way to target before acting.”

Tuesday, June 25

- 07:00 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will give a speech on US monetary policy and bank capital reform in London. Speech text and a Q&A are expected. On May 3, Bowman said “at its current setting, our monetary policy stance appears to be restrictive, and I will continue to monitor the incoming data to assess whether monetary policy is sufficiently restrictive to bring inflation down to our target. As I’ve noted recently, my baseline outlook continues to be that inflation will decline further with the policy rate held steady, but I still see a number of upside inflation risks that affect my outlook.”

- 09:00 AM FHFA house price index, April (consensus +0.3%, last +0.1%)

- 09:00 AM S&P Case-Shiller 20-city home price index, April (GS +0.26%, consensus +0.30%, last +0.33%)

- 10:00 AM Conference Board consumer confidence, June (GS 101.0, consensus 100.0, last 102.0)

- 10:00 AM Richmond Fed manufacturing index, June (consensus -3, last 0)

- 12:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will speak about the economic outlook at the Economic Club of New York. Speech text and a Q&A are expected.

- 02:10 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will give recorded opening remarks at the Midwest Cyber Workshop. Speech text is expected.

Wednesday, June 26

- 10:00 AM New home sales, May (GS -1.4%, consensus +2.1%, last -4.7%)

Thursday, June 27

- 08:30 AM Advance goods trade, May (GS -$96.0bn, consensus -$96.0bn, last -$98.0bn)

- 08:30 AM GDP, Q1 third release (GS +1.3%, consensus +1.4%, last +1.3%); Personal consumption, Q1 third release (GS +2.0%, consensus +2.0%, last +2.0%): We estimate no revision on net to Q1 GDP growth at +1.3% (qoq ar).

- 08:30 AM Initial jobless claims, week ended June 22 (GS 230k, consensus 235k, last 238k): Continuing jobless claims, week ended June 15 (last 1,828k)

- 08:30 AM Durable goods orders, May preliminary (GS -1.2%, consensus -0.1%, last +0.6%): Durable goods orders ex-transportation, May preliminary (GS +0.3%, consensus +0.1%, last +0.4%); Core capital goods orders, May preliminary (GS +0.5%, consensus +0.1%, last +0.2%); Core capital goods shipments, May preliminary (GS +0.5%, consensus +0.3%, last +0.4%): We estimate that durable goods orders fell 1.2% in the preliminary May report (mom sa), reflecting weak commercial aircraft orders. However, we forecast strength in the core measures, including 0.5% increases in both core capital goods shipments and core capital goods orders, based on solid US and foreign manufacturing activity.

- 10:00 AM Pending home sales, May (GS +0.6%, consensus +1.8%, last -7.7%)

- 09:00 PM U.S. Presidential Debate: The first U.S. Presidential debate will take place on CNN and CNN.com

Friday, June 28

- 06:00 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will give a keynote speech followed by a Q&A at the Global Interdependence Center’s conference in Paris, France. A Q&A is expected. On June 18, Barkin said that the May inflation figures were “very encouraging,” but that he would like to see “sustainment and broadening of inflation progress.” He also said that a scenario where the FOMC cuts rates once and then holds would be “sensible.”

- 08:30 AM Personal income, May (GS +0.4%, consensus +0.4%, last +0.3%); Personal spending, May (GS +0.26%, consensus +0.3%, last -0.1%); PCE price index, May (GS +0.03%, consensus flat, last 0.3%); PCE price index (yoy), May (GS +2.51%, consensus +2.6%, last +2.7%); Core PCE price index, May (GS +0.13%, consensus +0.1%, last +0.2%); Core PCE price index (yoy), May (GS +2.59%, consensus +2.6%, last +2.8%): We estimate personal income increased 0.4% and personal spending increased 0.26% in May. We estimate that the core PCE price index rose +0.13%, corresponding to a year-over-year rate of 2.59%. Additionally, we expect that the headline PCE price index increased by 0.03% from the prior month, corresponding to a year-over-year rate of 2.51%. Our forecast is consistent with a 0.15% increase in our trimmed core PCE measure (vs. +0.21% in April and +0.24% in March).

- 09:45 AM Chicago PMI, June (GS 42.0, consensus 40.0, last 35.4): We estimate that the Chicago PMI rebounded by 6.6pt to 42.0 in June, reflecting solid global manufacturing activity and upward convergence toward other manufacturing surveys (GS tracker +1.1pt to 49.9).

- 10:00 AM University of Michigan consumer sentiment, June final (GS 65.2, consensus 66.0, last 65.6): University of Michigan 5-10-year inflation expectations, June final (GS 3.0%, last 3.1%): We expect the University of Michigan consumer sentiment index decreased to 65.2 in the final June reading. We estimate the report’s measure of long-term inflation expectations pulled back 0.1pp to 3.0%, reflecting the decline in gasoline prices and the lower-than-expected May price data.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 06/24/2024 – 09:53