Yields Tumble After Dovish Refunding Reveals Debt Sales In Line With Expectations, No Coupon Auction Increases „For Several Quarters”, And Treasury Buybacks Begin

Having already revealed its borrowing estimates for Q2 and Q3 on Monday, where we learned that the Treasury expects to sell $41BN more debt than previously expected in Q2, but offset by a below-estimate $847BN in Q3 (which pushes TSY cash levels to $850BN, so really $747BN assuming $750BN in quarter end cash), moments ago the Treasury published the balance of its Quarterly Refunding Announcement where there were also no surprises as Janet Yellen left the quarterly issuance of longer-term debt unchanged on Wednesday as widely expected, while repeating what it said last quarter namely that „based on current projected borrowing needs, Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters.” Finally, the Treasury announced that its first program to buy back existing securities in more than two decades will kick off this month with the first operation intended for May 29, and also unveiled that 6 week cash management bills would be converted into a regular benchmark bill.

Here are the details:

The Treasury Department said in a statement Wednesday it will sell $125 billion of securities at its so-called quarterly refunding auctions next week; the proceeds will be used to refund $107.8 billion of Treasury notes maturing on May 15, 2024. This issuance will raise new cash from private investors of approximately $17.2 billion. The securities are:

- A 3-year note in the amount of $58 billion, unchanged from the April auction, and up $4 billion from the February refunding auction

- A 10-year note in the amount of $42 billion, up $3 billion from the April auction, and unchanged from the February refunding auction

- A 30-year bond in the amount of $25 billion, also up $3 billion from the April auction, and unchanged from the February refunding auction

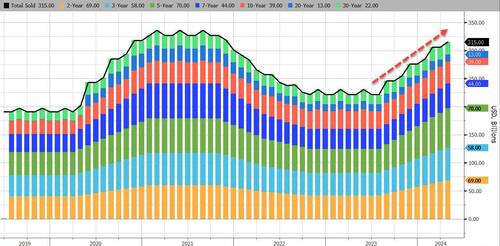

While the 10 and 30-year auctions saw $3BN increases in total notional from the April level, Two-, three-, five- and seven-year auction sizes were kept steady. Putting the refunding in context, the $125BN gross total compares to a peak of $126BN first reached in Feb. 2021, as auction sizes across the curve began rising in 2018 to finance tax cuts and surged in 2020 to finance the pandemic response which sent US debt into orbit.

What is much more important, however, is the Treasury’s confirmation that „based on current projected borrowing needs, Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters.”

The table below presents, in billions of dollars, the actual auction sizes for the February to April 2024 quarter and the anticipated auction sizes for the May to July 2024 quarter:

As shown above, the Treasury said the auction sizes for the May to July quarter of the 10-year note, 20- and 30-year bonds will follow the same pattern as the February to April period. The Treasury also plans to maintain May 10-year TIPS reopening auction size at $16b; will raise both June 5-year TIPS reopening by $1b as well as July 10-year TIPS new issue

“Since August 2023, Treasury has significantly increased issuance sizes for nominal coupon and FRN securities. Treasury believes these cumulative changes leave it well positioned to address potential changes to the fiscal outlook and to the pace and duration of future SOMA redemptions,” the Treasury said, a trend shown in the chart below.

All in all, this is good news for coupon issuance which some had expected would see a sizable increase this quarter with Bill issuance turning negative (on a net basis), but that has clearly not happened.

And speaking of Bills, the Treasury said that given current fiscal forecasts, it expects to increase the 4-, 6-, and 8-week bill auction sizes in the coming days to ensure sufficient liquidity to meet our one-week cash needs around the end of May, just as we said it would, to take advantage of the recent bump in the reverse repo facility.

*75 COUNTERPARTIES TAKE $505.530B AT FED REVERSE REPO OP.

That’s a LOT of Bill excess capacity, and far less coupons required

— zerohedge (@zerohedge) April 29, 2024

Then, in anticipation of the June 15th non-withheld and corporate tax date, Treasury expects to implement modest reductions to short-dated bill auction sizes during early to mid-June. Subsequently, over the course of July, Treasury anticipates returning short-dated bill auction sizes to levels at or near the highs from February and March.

While most of the Refunding was as expected, there were two notable surprises:

- the introduction of the 6-week bill benchmark and

- the launch of widely expected Treasury buybacks.

Starting with the first, the Treasury writes that given the outlook for T-bill supply over the medium term and after gathering feedback from a variety of market participants, including the primary dealers and Treasury Borrowing Advisory Committee, Treasury intends to change the regular 6-week CMB into a benchmark bill (part of the regular weekly bill issuance schedule going forward) as „Investor reception to the 6-week CMB has been strong, and elevation to benchmark status will further support demand.”

And some more details:

Over the coming quarters, Treasury plans to make necessary operational and systems changes in order to smoothly transition the 6-week CMB to benchmark status. During this transition, Treasury will continue with weekly issuance of the 6-week CMB. Treasury also intends to maintain the Thursday settlement and maturity cycle when the 6-week CMB becomes a benchmark bill. Additional implementation details, including the likely timing of the first benchmark auction, will be provided at an upcoming refunding.

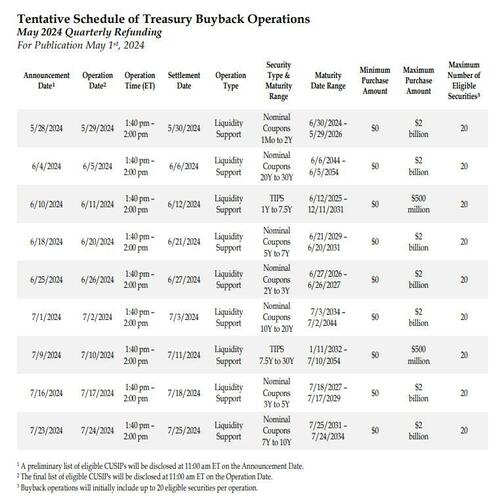

Even more important is that today the Treasury announced the launch of the widely anticipated Treasury buyback program with the first operation intended for Wednesday, May 29th. These operations will be aimed at „supporting market liquidity and improving cash management” but really are just a remind that the Fed-Treasury complex will never allow bond prices to plunge to dangerous levels, and whether it is buybacks or YCC, someone will always step in. Through July 2024, Treasury plans to conduct weekly Liquidity Support buybacks of up to $2 billion per operation in nominal coupon securities and up to $500 million per operation in TIPS. Treasury officials had spent more than a year analyzing the merits of buybacks and working out the structure for them. A tentative buyback schedule is as follows:

In each operation, Treasury will seek offers for no more than 20 CUSIPs, due to temporary settlement process limitations. Once these settlement process limitations are addressed, Treasury plans to remove the 20 CUSIP cap and move towards operation sizes consistent with its previous guidance (e.g., maximum of $30 billion per quarter across buckets for Liquidity Support). Treasury will provide an update on this transition at the next refunding.

As an aside, the upcoming buybacl program bears little resemblance to the buybacks from more than two decades ago. Those were launched during an historic period of budget surpluses, which gave officials the luxury of retiring some outstanding, higher-interest securities.

To summarize today’s dovish QRA:

- i) no coupon size increase, as some had feared

- ii) Treasury buybacks begin, further easing concerns about where the „buyer of last resort” will come from (at least until QE restarts).

And then there is the start of QT tapering expected to be announced later today: as a reminder, pressure on the Treasury is expected to further ease when the Fed eserve slows its run-off of US government securities holdings, something many dealers see likely to be announced later on Wednesday, as the Fed indicates that instead of $60BN in Treasury the Fed allows to run off its balance sheet every month, the Fed will taper the taper (so to speak) to just $30BN before it eventually tapers it to zero. In doing so, the gross funding need will drop even further.

Fed policymakers are set to release their policy statement at 2 p.m. in Washington. Chair Jerome Powell’s subsequent press briefing may offer clues on whether officials still expect to lower interest rates later this year — something that could further help the Treasury stem its surging debt-interest bill.

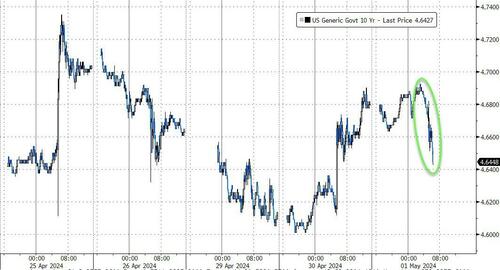

Until then, however, yields are dumping and thanks to the far more dovish than some had expected Quarterly Refunding, the 10Y yields is back down to 4.64%, down from 4.69% earlier and has erased almost the entire move following yesterday’s red hot Employment Cost Index (thanks to soaring government and union wages).

And now we wait for the Fed to announce that it is tapering the taper, and sending yields tumbling even more.

Tyler Durden

Wed, 05/01/2024 – 09:27