Bonds & Bitcoin Bid (But Not Stocks) As 'Bad’ News Jolts Rate-Cut Hopes Back To Life

Weak labor market data (JOLTS big miss) and mixed Orders (Manufacturing beat, Durables miss) sent 'hard’ data’ to its weakest since the start of the year..

Source: Bloomberg

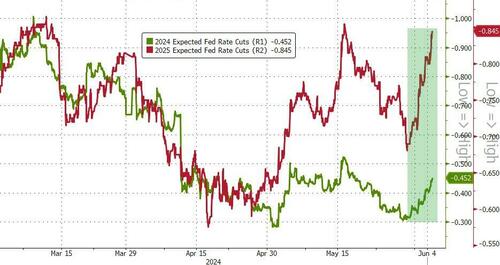

…and that 'bad’ news was enough to spark another dovish leg higher in rate-cut expectations…

Source: Bloomberg

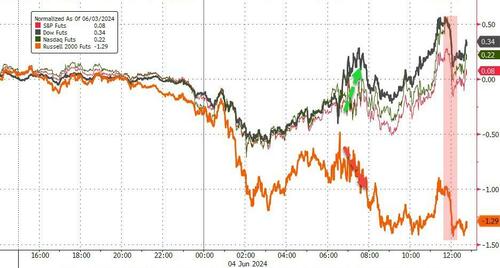

BUT… and its a big but, stocks didn’t love the 'bad news’. Small Caps were particularly ugly but an afternoon srge lifted the majors green but they could not hold all the gains…

Source: Bloomberg

As David Rosenberg noted on X:

„The fact that equities are not responding well to the renewed pullback in Treasury yields and the swaps market beginning to price in a September rate cut is signaling something important: that stock market investors are also becoming concerned about the economic slowdown and what it means for the earnings outlook.”

And as Goldman’s trading desk noted, volumes extremely muted tracking -15% vs the 20dma with S&P top of book down after elevated levels in May.

-

Our floor is much better for sale, led mostly by HF longs, although LO’s are also better for sale but activity feels muted from the group.

-

HFs are selling tech, industrials, and macro products. Important to note they are not better buyers of any sector across our floor today.

-

LOs are buying tech + Hcare, vs selling Industrials.

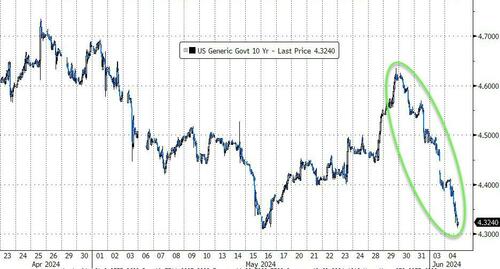

On the other hand, bonds were clear on which direction to head (lower in yield) with the long-end marginally outperforming, and the yield curve flattening (inverting deeper) for the last four days…

Source: Bloomberg

The 10Y yield closed at its lowest in two months…

Source: Bloomberg

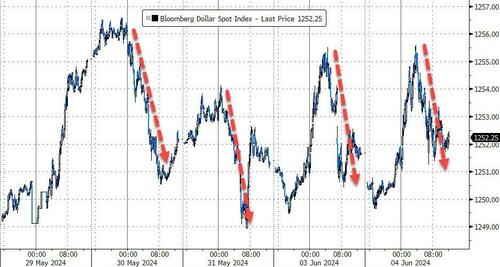

The dollar whipsawed AGAIN today, spiking overnight, only to be sold during the US session to end flat on the day…

Source: Bloomberg

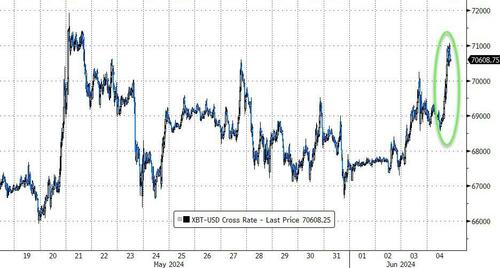

Bitcoin surged back up to $71,000 today…

Source: Bloomberg

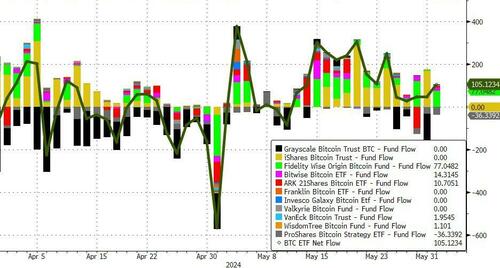

…after the 15th straight day of net inflows into BTC ETFs…

Source: Bloomberg

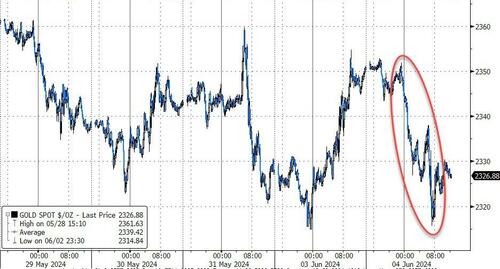

Gold slipped back to yesterday’s lows (ignoring the dollar’ retreat this afternoon)…

Source: Bloomberg

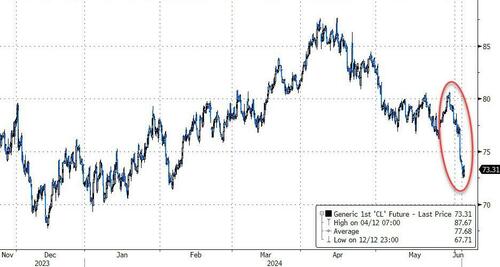

Oil prices plunged back to a $72 handle (WTI) – the lowest in four months…

Source: Bloomberg

Finally, as economic data continues to underwhelm (ISM Manuf, JOLTs), the US economic surprise index has inflected to its lowest level in 5+ years…

Source: Bloomberg

..but Goldman’s Cylicals vs Defensive pair remains in full growth mode.

Who will be right?

Tyler Durden

Tue, 06/04/2024 – 16:00