Hedge Funds That Sold In May Might Now Push Stocks To New Highs

Authored by Simon White. Bloomberg macro strategist,

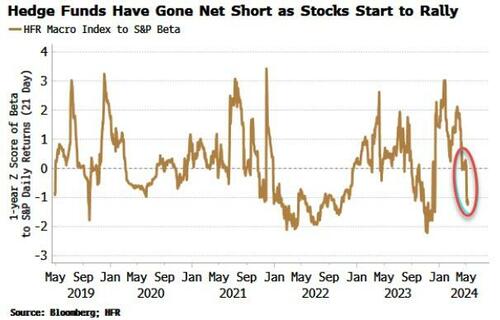

Hedge funds seem to have taken the old adage about selling in May to heart. From being very long for most of this year, aggregate positioning now looks to have gone short – right as the stock market bounces. Hedge funds that are offside might now chase the market higher through the rest of the month.

We can estimate how hedge funds are positioned in stocks by looking at the beta of hedge-fund indices (in this case HFR’s Macro/CTA index) to the S&P 500. As the chart below shows, it looks like funds are now short the stock market in the aggregate.

We can use the DBi Managed Futures ETF to get a flavor of what CTAs have been doing. As the table below shows, this ETF came out of the S&P in April and started adding to the MSCI EAFE, with its overall developed-market equity position trending lower. As of last week, it is long futures in MSCI EAFE, MSCI EM, oil and gold.

Hedge funds (CTAs and macro funds) now having a short exposure to stocks comes at a time when the good side (for long-only investors at least) of a positive stock-bond correlation is in play – stocks and bonds rising together, as yields trend lower in response to recent weaker economic data. The bear steepening in the yield curve that is typically pernicious for risk assets has given away to a more asset-friendlier bull flattening for now.

With US stocks less than a percent off their all-time highs, there’s a good chance funds who now find themselves offside help push the stock market to a new peak. This would match the previous patterns of a change of stock leadership marking the near-end of a correction.

Nonetheless, even though a new high would likely see some follow-through buying, the bull trend is not going to be as plain sailing as it was.

Liquidity conditions are less conducive to rising risk assets. Reserves and the reverse repo facility (RRP) continue to trend lower. Tapering of quantitative tightening will take some of the edge off, but reserve liquidity will be less buoyant. Furthermore, the government’s interest bill will incrementally eat more reserves and reserve velocity.

Selling in May maybe doesn’t look like a good idea now, but by St Leger’s Day in September, hedge funds who get back in the market might find they have experienced a lot of volatility without a whole lot of upside to compensate.

Tyler Durden

Fri, 05/10/2024 – 17:15